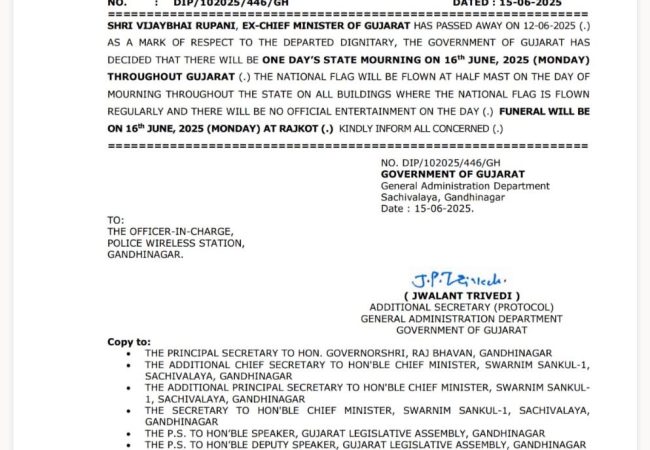

રાજયના મૃદુ અને મક્કમ મુખ્યમંત્રી...

તળાવમાં ડૂબતો મોહલ્લા: શહેરની નજીક ગામ જેવી...

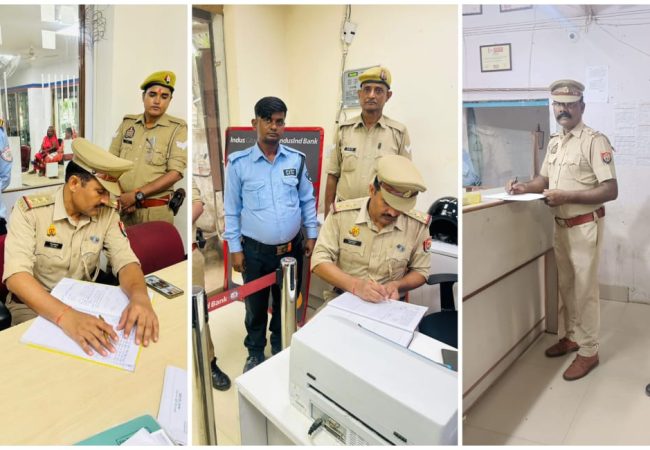

ઔરૈયા (યુપી). પોલીસ સર્કલ ઓફિસર સદર અશોક કુમારે...

પત્ની પ્રેમી સાથે ભાગી ગઈ, પતિને ડર છે કે પુત્રી...

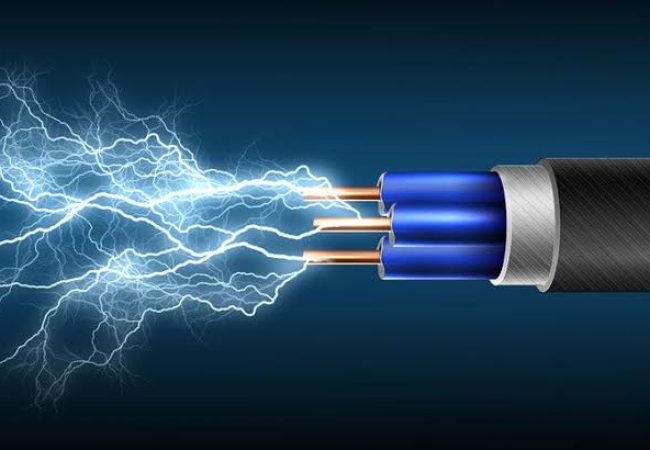

કાનપુર, કાનપુર શહેરમાં વીજળીની સમસ્યાઓના...

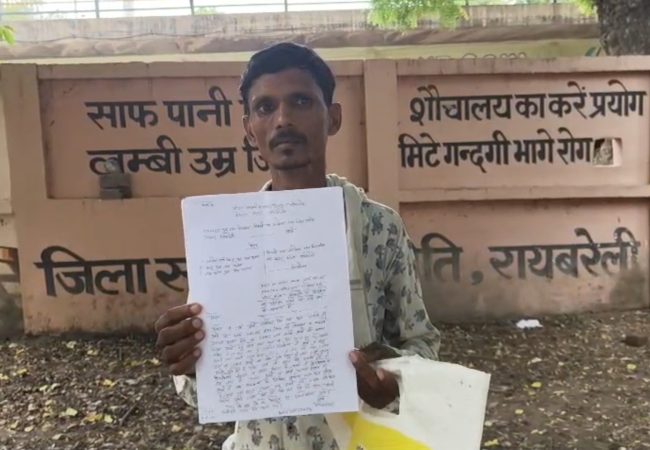

રાયબરેલી. લખનૌના નાગરમ પોલીસ સ્ટેશન વિસ્તારના...

બ્રેકિંગ આહરૌરા પોલીસ સ્ટેશન વિસ્તારમાં...

સાબરકાંઠા જિલ્લામાં પશુપાલન સાથે સંકળાયેલા...

ઇકદિલ, રાત્રે ભારે વરસાદ અને તોફાની પવનને...

ગુજરાતમાં દારુબંધી હોવા છતા અવારનવાર દારુ...

કચ્છી પ્રજાની સમસ્યા, તેના અરમાનો અને તેની...

ગ્રામ પંચાયત અભયપુરમાં સ્વચ્છ ભારત મિશનનું...

શુક્રવારે, ઇટાવાના ફ્રેન્ડ્સ કોલોની પોલીસ...

શુક્રવારે ઇટાવાના સિવિલ લાઇન વિસ્તારમાં...

વારાણસીના ભૈસાસુર ઘાટ ખાતે વારાણસી નિષાદરાજ...

વારાણસીના કોતવાલી પોલીસે બારા નંબર 5...

કેમિસ્ટ એસોસિએશન લાખણાના નેજા હેઠળ, લખણાના JVS...

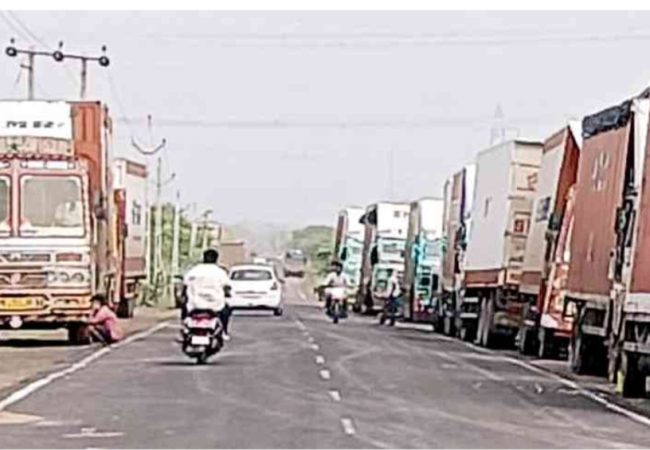

ભરથાણા: શુક્રવારે સવારે, ઇટાવા-કનૌજ હાઇવે પર...

બકેવાર શહેરના ઇટાવા રોડ પર એક વેલ્ડીંગની દુકાન...

ઇટાવા: ગુરુવારે ભારે વરસાદ પછી, શહેરના મેવાતી...

મિર્ઝાપુર: વાવાઝોડા અને વરસાદથી ભારે વિનાશ થયો...

મિર્ઝાપુર. થાણા શહેર કોતવાલી વિસ્તારના રામાઈ...

કાશીમાં કારગિલ વિજય દિવસની ઉજવણી કરવામાં આવી...

ઔરૈયા. પોલીસ અધિક્ષકના નિર્દેશનમાં ચલાવવામાં...

*ખેરી પોલીસે ગેરકાયદેસર હથિયારોથી વીજ વિભાગના...

નીમગાંવ પોલીસ સ્ટેશને બળાત્કાર અને પોક્સો...

કાનપુર મેટ્રોએ આજે ICC ગ્રુપના સહયોગથી 'ઓપરેશન...

ઔરૈયા જિલ્લાના અચલદા પોલીસે બે વોરંટ આરોપીઓની...

૨૬ જુલાઈના રોજ, કારગિલ વિજય દિવસ પર, ભારતીય જનતા...

પ્રતાપગઢ. સમાજવાદી પાર્ટી કાર્યાલય મીરા ભવન...

કાનપુર, ઓમકારેશ્વર સરસ્વતી વિદ્યા નિકેતન...

કાનપુર, આજે શુક્રવારે, ઓલ ઈન્ડિયા હમારા સમાજ...

કાનપુર: સમાજવાદી પાર્ટીના રાષ્ટ્રીય અધ્યક્ષ...

કાનપુર, કાનપુર ઉદ્યોગ વ્યાપાર મંડળની જિલ્લા...

કાનપુર, આજે કાનપુર મહાનગર કોંગ્રેસના પ્રમુખ...

બાળ મજૂરી, બાળ ભીખ માંગવી, બાળ લગ્ન, વ્યસન...

કાનપુર, આજે દિવ્યાંગ સશક્તિકરણ નિયામકમંડળના...

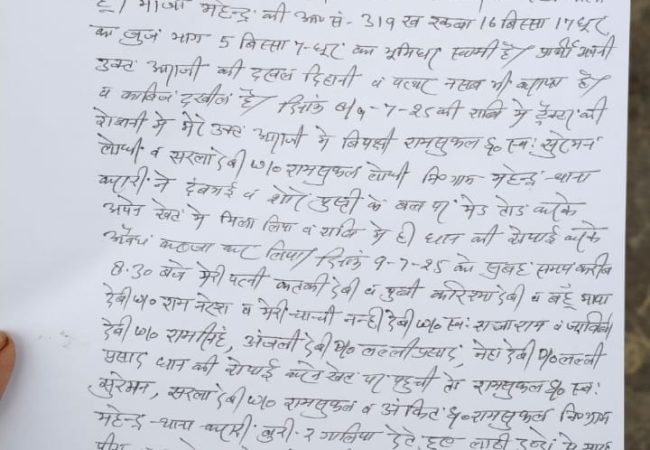

મૈનપુરી જિલ્લાના ભોગાવના પદુઆ રોડની રહેવાસી...

મૈનપુરીના જિલ્લા મુખ્ય પશુચિકિત્સા અધિકારી...

રાનીબાગ અને પીલી કોઠી વિસ્તારમાં મોટા પાયે...

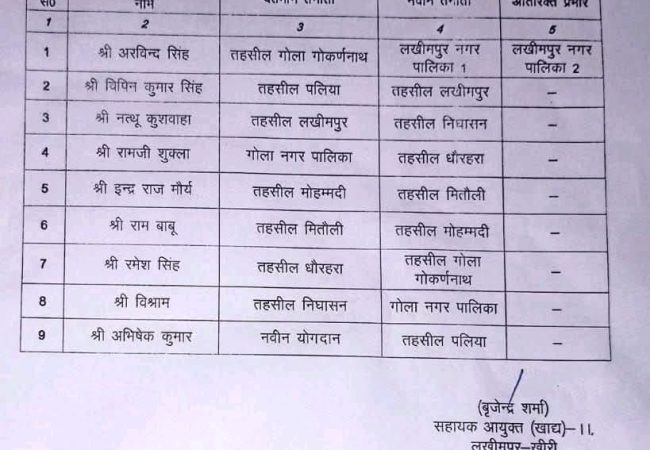

સબ-ડિસ્ટ્રિક્ટ મેજિસ્ટ્રેટ અને તહસીલદાર...

લખીમપુર ખીરી *થાણા ફરદાન વિસ્તાર હેઠળના અલીપુર...

પ્રતાપગઢ. જર્નાલિસ્ટ કાઉન્સિલ ઓફ ઈન્ડિયા...

પ્રતાપગઢ. વકીલોની બેઠકમાં લેવાયેલા નિર્ણય...

પ્રતાપગઢ. જિલ્લા જેલના કેદી રક્ષકોએ જિલ્લા...

પ્રતાપગઢ. પ્રતાપગઢ નગર પાલિકા પરિષદ બેલા,...

કુશીનગર પોલીસે બોલેરો વાહન સહિત હત્યાના...

શુક્રવારે ઇટાવામાં બાળ મજૂરી નાબૂદી અંગે...

લક્ષ્મીપુરમાં તળાવમાં ઝેર નાખીને બે લાખ...

નેબુઆ નૌરંગિયા પોલીસ સ્ટેશનમાં બળી ગયેલ...

વાવાઝોડા અને વરસાદને કારણે વીજ વ્યવસ્થા...

વિષ્ણુપુરા વિકાસનું ઉદાહરણ બને છે, નીતિ આયોગ...

કુશીનગરમાં ગાંજાની દાણચોરીનો મોટો ખુલાસો, ૧.૨૮...

ઇટાવામાં, એસએસપી બ્રિજેશ કુમાર શ્રીવાસ્તવના...

ઔરૈયા. શુક્રવારે જિલ્લામાં શાંતિપૂર્ણ રીતે...

મુખ્યમંત્રી શ્રી ભૂપેન્દ્રભાઈ પટેલે આજે આણંદ...

મ્યુનિસિપલ ચેરમેન શ્યામસુંદર કેસરીએ સ્ટેશન...

રાયબરેલીના એક ખાનગી નર્સિંગ હોમમાં સારવાર...

ઇટાવામાં રિઝર્વ પોલીસ લાઇન ખાતે શુક્રવારની...

મૈનપુરી જિલ્લાના ભોગાવ તહસીલમાં સ્થિત...

ઔરૈયા જિલ્લામાં મિશન સમાધાન હેઠળ, બિધુના...

સુનિષ્ઠા સિંહે મૈનપુરી જિલ્લાના ભોગાવ...

કાળઝાળ ગરમીમાં શાળાઓમાં પાણીની કટોકટી, છોકરીઓ...

ઔરૈયા. કોતવાલી પોલીસે જુગાર રમતા 7 લોકોની...

લખીમપુર ખીરી* પોલિથીન બેગમાં પુસ્તકો લાવવામાં...

મિર્ઝાપુર. વિંધ્યાચલ પોલીસ સ્ટેશનના ચાંબે...

રાયબરેલી. સલોન કોતવાલી વિસ્તારના સુચી દાસવાન...

મિર્ઝાપુર: ભારતનું પ્રખ્યાત મા વિંધ્યાવાસિની...

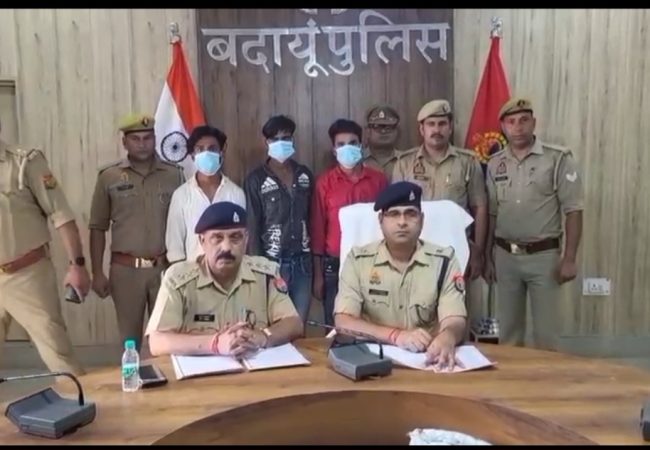

બદાયૂં પોલીસ સ્ટેશન બિલસી નગરમાં આવેલા એક ઢાબા...

મૈનપુરી જિલ્લાના ભોગાવ સ્થિત નેશનલ ઇન્ટર...

લખીમપુર ખીરી ઘણા મહિનાઓથી શાળામાં વીજળી નહોતી,...

બદાયૂંમાં ટ્રેક્ટર દ્વારા કચડાઈ જવાથી એક...

હૈદરાબાદ પોલીસ સ્ટેશને ગેરકાયદેસર પિસ્તોલ...

બદાયૂંમાં શ્રાવણ મહિનામાં એક પછી એક ચમત્કાર...

વારંવાર વીજકાપને લઈને પાલિયા શહેરના વેપારીઓએ...

મિર્ઝાપુર. સમાજવાદી પાર્ટીના નેતા અને...

ટ્રેનની અડફેટે આવતા ગાયોના મોત. હિન્દુ...

બદાયૂંમાં માનવતાને શરમાવે તેવી એક ઘટના...

ઉત્તર પ્રદેશ કોંગ્રેસના પ્રદેશ પ્રમુખ અજય...

AK-47 ગેંગે પત્રકારને મારી નાખવાની ધમકી આપી, કેસ...

નેબુઆ નૌરંગિયા: પરિણીત મહિલાએ પતિ પર ગેંગરેપ,...

રાયબરેલી. સદર તહસીલ વહીવટીતંત્ર દ્વારા...

રાજ્ય સરકાર દ્વારા ખાસ કરીને જન્માષ્ટમીના...

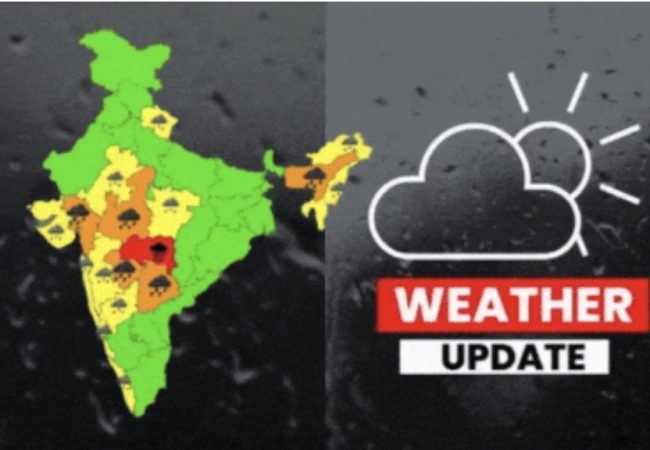

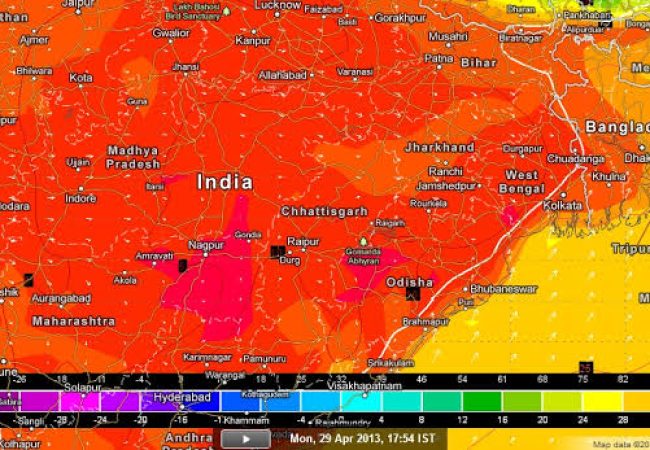

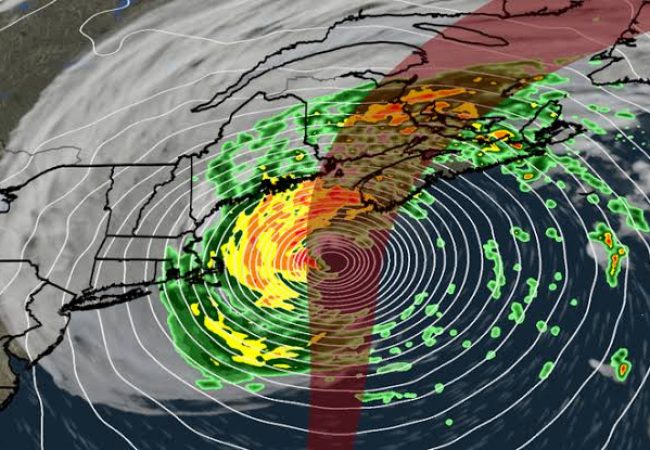

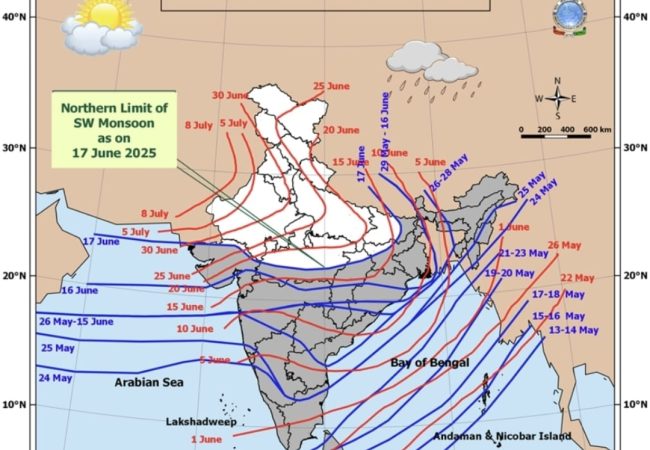

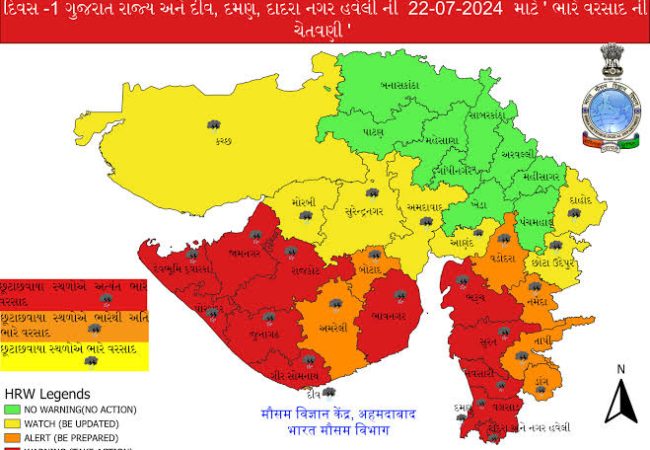

ગુજરાતમાં ફરીથી ચોમાસું ધીરે ધીરે જામી રહ્યું...

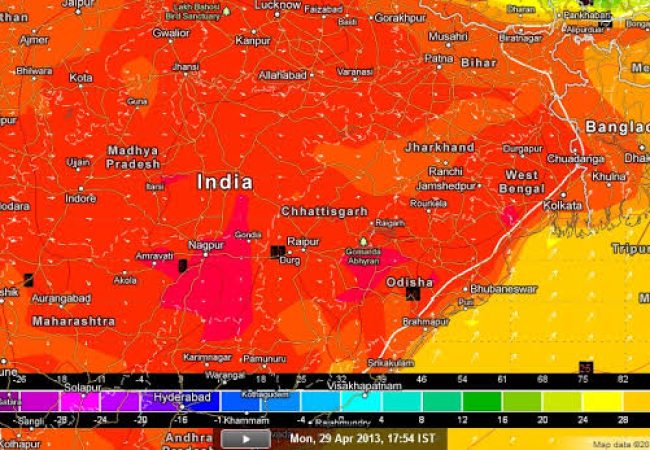

ભીષણ ગરમીથી જનજીવન પ્રભાવિત, વીજળી વિભાગ પણ...

ફરુખાબાદ: - જિલ્લા મેજિસ્ટ્રેટ આશુતોષ કુમાર...

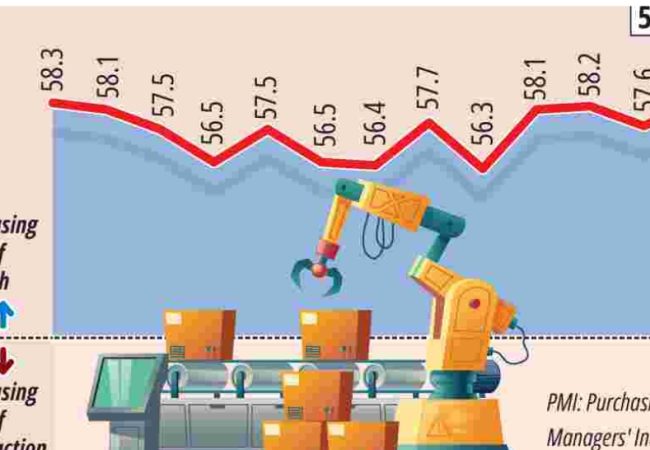

મુંબઈ,તા. 22 જુલાઈ, 2025: ભારતમાં નયારા એનર્જી તેના...

કર્મચારીઓની છટણીને કારણે વીજળી વ્યવસ્થા ઠપ થઈ...

સીડીઓએ બ્લોક નાખાનું ઓચિંતું નિરીક્ષણ કર્યું,...

*તારીખ - 25.07.2025* ▶ *કનૌજ પોલીસ UP-112 માં નવા PRV વાહનો...

આણંદ અને વડોદરાને જોડતો તેમજ સૌરાષ્ટ્ર જવા...

વડોદરા ઝોન હસ્તકના ૬ જિલ્લાની ૨૫ નગરપાલિકામાં...

મૈનપુરી જિલ્લાના બેવાર વિસ્તારમાં આવેલી...

ઔરૈયા. ફાફુંડ રેલ્વે સ્ટેશન ઓવર બ્રિજ પર 3...

ગુરુવારે મોડી સાંજે, રાયબરેલીના દેવપુરીમાં...

ફર્રુખાબાદ:- પોલીસે ડ્રોન કેમેરાથી ગુમ થયેલા...

બાબુ માતંગ દ્વારા : નિરોણા (પાવરપટ્ટી), તા. 24 :...

ઔરૈયા તહસીલ વિસ્તારમાં મિશન સમાધાન અભિયાન...

ફરુખાબાદ:- મૂળભૂત શિક્ષણ વિભાગમાં આકર્ષક પદ...

ભુજ, તા. 24 : અહીંના 20 વર્ષથી કચ્છને કર્મભૂમિ...

હેમાંગ પટ્ટણી દ્વારા : ભુજ, તા. 24 : પાકિસ્તાન સાથે...

નડિયાદ મ્યુનિસિપલ કોર્પોરેશન દ્વારા શહેરના...

પેટલાદ શહેરના ગોપાલપુરામાં સ્માર્ટ મીટર...

સ્થાન કૌશામ્બી સંવાદદાતા શ્રવણ તિવારી...

ઔરૈયા. અજિતમલ વિસ્તારના સુરન્યાદા ગામમાં અનુજ...

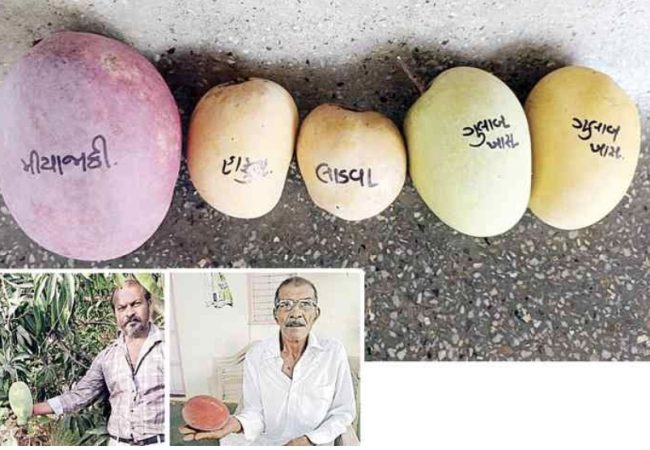

બોરસદ તાલુકાના ઝારોલા ગામના દર્શિતભાઈ...

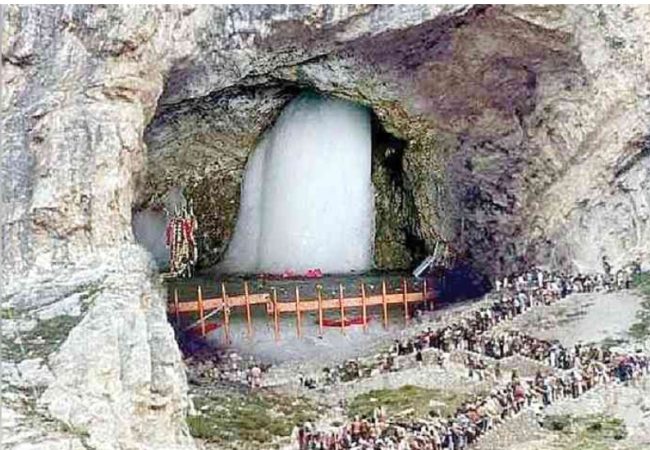

આજથી પવિત્ર શ્રાવણ માસની શરૂઆત થઈ ગઈ છે. શ્રાવણ...

ઔરૈયા. બિધુના તહસીલના ઇન્દાપામઉ ગામની હાલત...

બદાયુમાં, એક નોકરે લૂંટની ખોટી વાર્તા બનાવી...

બદાયૂંમાં થયેલા 65 લાખ રૂપિયાના વીજળી બિલ...

રાયબરેલી પેન્શન અપાવવાના નામે એક વૃદ્ધ...

બદાયૂં બિનાવર પોલીસ સ્ટેશન વિસ્તારમાં ગઈકાલે...

ફરુખાબાદ:- સજા ભોગવી રહેલા કેદીની હાલત બગડતા...

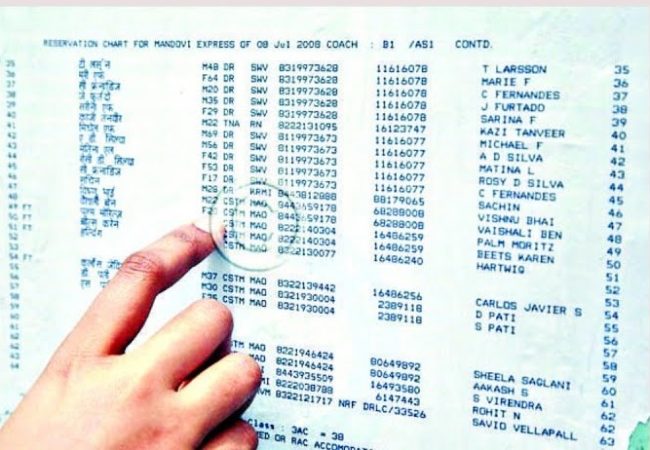

ફર્રુખાબાદ: ડિવિઝનલ રેલ્વે મેનેજરે...

ફર્રુખાબાદ: છેલ્લા બે દિવસથી ચર્ચાનો વિષય...

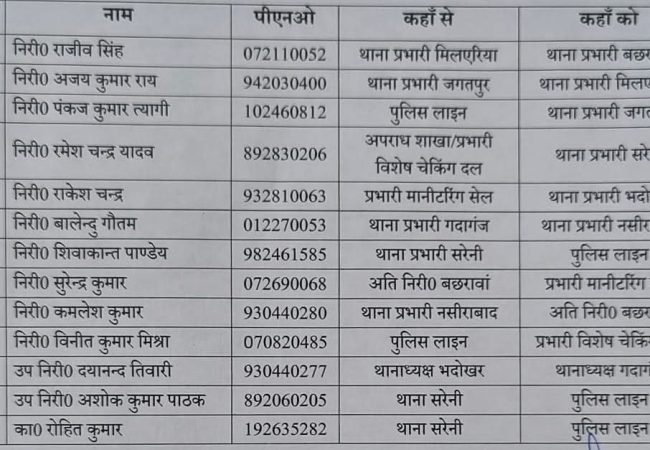

રાયબરેલી એક સાથે ૧૩ પોલીસ કર્મચારીઓના...

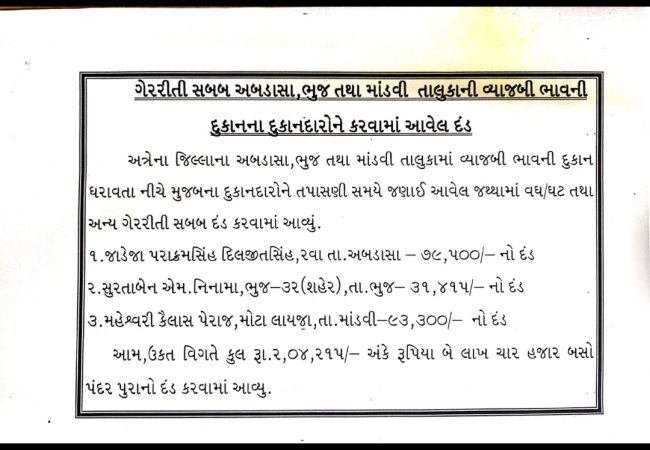

ભુજ, તા.22 : જિલ્લા કલેકટર આનંદભાઈ પટેલના...

ગિરીશ જોશી દ્વારા : ભુજ, તા. 23 : કચ્છમાં જાગૃતિનો...

ગાંધીધામ, તા. 23 : ગુજરાતના ઔદ્યોગિકરણનાં...

નખત્રાણા, તા. 23 : અહીંની તાલુકા પંચાયત કચેરીના...

અમદાવાદ, તા. 23 : વિશ્વભારતી સંસ્થાન તથા એસજીવીપી...

મુંદરા, તા. 23 : મુંદરા તાલુકામાં ચાલતા...

ભુજ, તા. 23 : અહીંના વડનગરા નાગર જ્ઞાતિ વ્યવસ્થાપક...

ગાંધીધામ, તા. 23 : ગાંધીધામ અગ્રવાલ સમાજ, યુવા સંઘ...

અંજાર, તા. 23 : અંજાર રોટરી અને રોટરેક્ટ ક્લબના...

ગાંધીધામ, તા. 23 : અહીંની નૃત્ય સંસ્થા માર્ગમ...

આદિપુર, તા. 23 : કચ્છમાં મચ્છોયા આહીર સમાજ સંચાલિત...

કોટડા (ચકાર), તા.23 : કોટડા પંચાયતથી અલગ થયેલી...

બુધવારે માંડવીના પ્રવેશ માર્ગે ધાર્મિક...

માતાનામઢ, તા. 23 : માતાનામઢ જાગીર ટ્રસ્ટમાં...

ભુજ, તા. 22 : કચ્છની ધરતીમાં મહામૂલું ખનિજ...

અંજાર, તા. 23 : છેલ્લા ઘણા સમયથી રખડતા ઢોરોની...

કેરા (તા. ભુજ), તા. 22 : કચ્છીઓ જગતના કોઇ પણ ખૂણે વસે,...

ફતેહપુર જિલ્લાના વિજયપુર વિકાસ બ્લોકના મદૌલી...

ફતેહપુર. ભારતીય કિસાન યુનિયન અરાજકીયના જિલ્લા...

ફતેહપુર. જીએસટીના નામે રાજ્યના કર અધિકારીઓ...

ગુરુવારે, ક્વોટા ઓપરેટર ગ્રામજનો સાથે કલેક્ટર...

જિલ્લામાં મજબૂત કાયદો અને વ્યવસ્થા જાળવવાના...

ઇટાવા જિલ્લામાં જિલ્લા કાનૂની સેવા સત્તામંડળ...

ઇટાવા: ગુરુવારે બપોરથી સતત ભારે વરસાદ વચ્ચે...

વારાણસી. જિલ્લા મેજિસ્ટ્રેટ સત્યેન્દ્ર...

*વોરંટી આરોપી રાજેન્દ્ર પુત્ર રામનારાયણની...

હૈદરાબાદ પોલીસ સ્ટેશને 01 વ્યક્તિના વોરંટ...

ખેરી તારીખ 24.07.2025* *લખનૌ ઝોનના વધારાના પોલીસ...

ટ્રોલીની ટક્કરથી કનવરિયાનું દુઃખદ મૃત્યુ, લાશ...

રાયબરેલી બે ઘરમાંથી ૭૦ લાખ રૂપિયાની ચોરી થતાં...

ગુરુવારે ઇટાવાના સિવિલ લાઇન્સ પોલીસ સ્ટેશને...

લોકમાન્ય તિલક એ આપણને માર્ગ બતાવ્યો, જ્ઞાન અને...

ઇટાવાના જસવંતનગરના કોમ્યુનિટી હેલ્થ...

મિર્ઝાપુર. વિકાસ ભવનના સભાગૃહમાં જિલ્લા...

ખાનગી હોસ્પિટલમાં સરકારી દવાઓ મળી આવવાના...

બાળકોને લઈ જતી ઓમ્ની કાર બાઇક સાથે અથડાઈ,...

મેયર અશોક કુમાર તિવારી અને મ્યુનિસિપલ કમિશનર...

ઇટાવા જિલ્લાના બકેવાર પોલીસ સ્ટેશન વિસ્તારના...

લખીમપુર ખેરીમાં આરોગ્ય વિભાગે મોટી કાર્યવાહી...

ઇટાવાના ભરથાણા કૃષિ ઉત્પદાન મંડીની હાલત...

મિતોલી ખેરી. મિતોલીના ઇન્ચાર્જ શિવાજી દુબેએ...

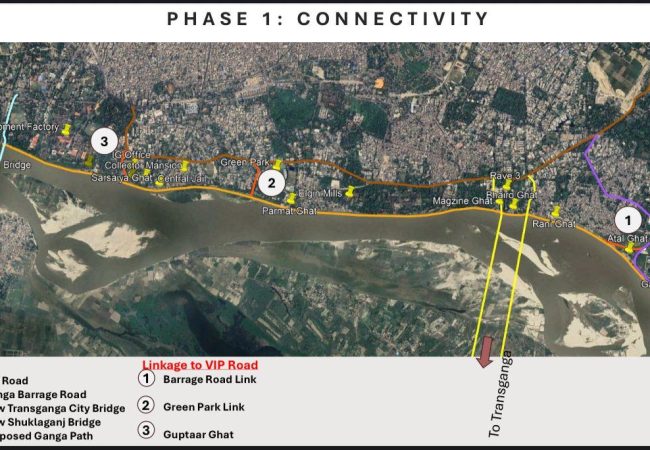

વારાણસી. વારાણસી વિકાસ સત્તામંડળ (VDA) દ્વારા...

રાષ્ટ્રીય મધ્યસ્થી ઝુંબેશ શરૂ, 15 કેસોમાં...

લોકમાન્ય તિલક જયંતિ પર રાષ્ટ્રીય પ્રેમ છવાઈ...

ખેરી જિલ્લામાં ૧ ઓગસ્ટના રોજ હરિ શંકરી વાવેતર...

સ્વચ્છતા તરફ વધુ એક પગલું: મ્યુનિસિપલ...

દુર્ગાકુંડ પોલીસ ચોકી પાછળ વક્ફ કાયદાના...

આવતીકાલે 25 જુલાઇ 2025ના રોજ મુખ્યમંત્રી...

પ્રતાપગઢ. બુધવારે મોડી રાત્રે કેમ્પ ઓફિસના...

પ્રતાપગઢ. એક્સાઇઝ અને પોલીસ ટીમે બે ગામોમાં...

પ્રતાપગઢ. કૃષિની નવીનતમ ટેકનોલોજીથી ખરીફ 2025-26...

ઔરૈયા. ૨૭ જુલાઈના રોજ પ્રસ્તાવિત સમીક્ષા...

ડિવિઝનલ કમિશનરની અધ્યક્ષતામાં આરોગ્ય વિભાગની...

રાયબરેલી ભાજપના પૂર્વ શહેર ઉપાધ્યક્ષ સંતોષ...

ઔરાઈ (યુપી). પોલીસ અધિક્ષક અભિજીત આર. શંકર અને...

રાપર , તા. 22 : પુલ દુર્ઘટના બાદ તંત્ર દ્વારા પ્રથડ...

ઔરૈયા. પોલીસ અધિક્ષક અને અધિક પોલીસ અધિક્ષકના...

ઔરૈયા. પોલીસ અધિક્ષક અભિજીત આર. શંકરના...

ઔરૈયા. પોલીસ મુખ્યાલય કાકોર ખાતે જાહેર સુનાવણી...

મિર્ઝાપુર. 'સોમેન બર્મા' સિનિયર...

ભુજ, તા. 23 : અબડાસાના જખૌ બંદરના લુણા બેટ પરથી...

ભુજ, તા. 23 : અહીં કચ્છ મહિલા વિકાસ સંગઠન, જિલ્લા...

ઔરૈયા. અજિતમાલ તાલુકાના બિસલપુર ગામમાં...

ભુજ, તા. 23 : શહેરમાં નવા માર્ગો બને અને વિવિધ...

માતાના મઢ, તા. 23 : પ્રસિદ્ધ યાત્રાધામ માતાના મઢ...

ગાંધીધામ, તા. 23 : ગાંધીધામ મહાનગરપાલિકામાં...

ઉત્તર પ્રદેશના ઇટાવાના બધપુરા વિસ્તારમાં...

મોટી વિરાણી (તા. નખત્રાણા), તા. 23 : ગામમાં ચોમેર...

નડિયાદના ધારાસભ્ય પંકજ દેસાઈએ માર્કેટિંગ...

*૨૫ જુલાઈના રોજ લખીમપુર-ગોલા રોડ બંધ રહેશે,...

આણંદના વહેરાખાડી રોડ પર ટેન્કરની ટક્કરે...

જળ શક્તિ મંત્રી સ્વતંત્ર દેવ સિંહ લખીમપુર...

ઔરૈયા. જિલ્લા મેજિસ્ટ્રેટ ડૉ. ઇન્દ્રમણિ...

વારાણસી. જિલ્લા મેજિસ્ટ્રેટ સત્યેન્દ્ર...

વારાણસી: ગુરુવારે, શેરી વિક્રેતાઓએ વડા પ્રધાન...

બદાયૂંમાં બળાત્કાર બાદ પીડિતાએ આત્મહત્યા કરી,...

નિઘાસન ખેરી ચોર સીસીટીવીમાં કેદ થયો, હજુ પણ...

ઇટાવામાં વરિષ્ઠ પોલીસ અધિક્ષક બ્રિજેશ કુમાર...

ધૌરહરા ખેરી ઈસાનગર પોલીસ સ્ટેશન હેઠળ આવતા...

સ્કોર્પિયોની ટક્કરમાં એકનું મોત, બે ઘાયલ,...

બદાયૂં મુસાઝહાગ પોલીસ સ્ટેશન વિસ્તારના...

ઇટાવાના નિઝામપુર ગામમાં દહેજ હત્યા કેસમાં...

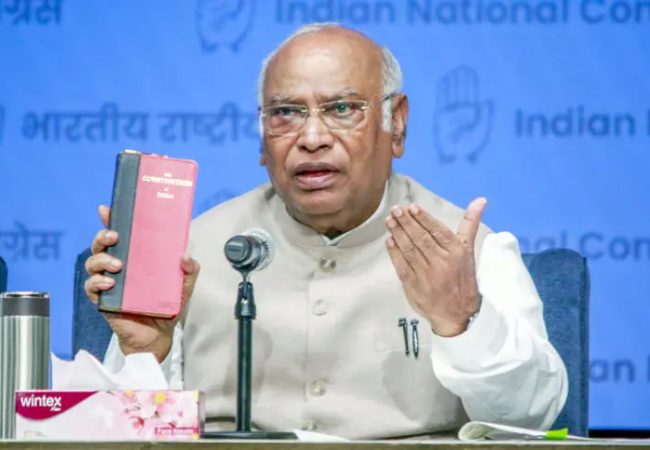

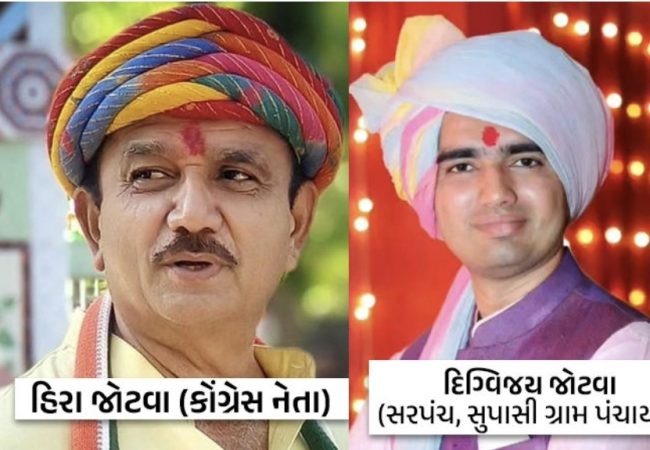

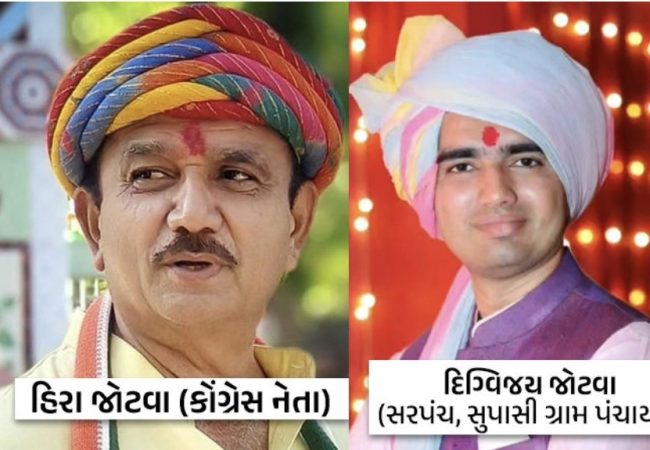

કોંગ્રેસ દ્વારા ગુજરાતના સંગઠન માળખામાં...

બેદરકારીને કારણે, પોલીસ અધિક્ષકે હલિયા પોલીસ...

રાયબરેલી. જિલ્લા મહિલા હોસ્પિટલની લિફ્ટમાં...

કાનપુર, ઉત્તર પ્રદેશ ઓટો લોડર યુનાઇટેડ વેલ્ફેર...

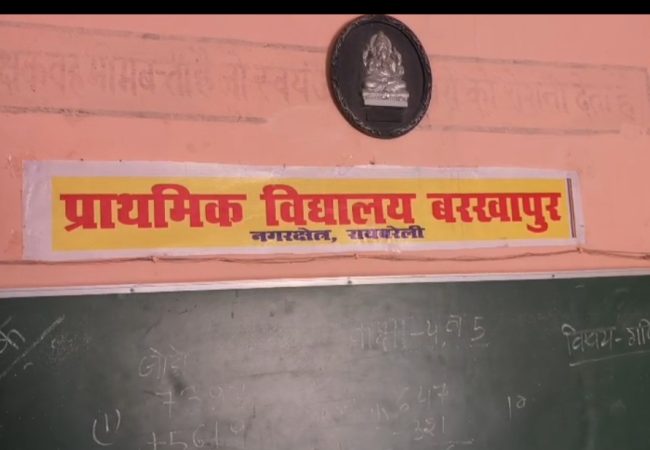

રાયબરેલી શહેર વિસ્તારમાં એક જ શાળામાં વારંવાર...

ઔરૈયામાં, જિલ્લા કાનૂની સેવા સત્તામંડળે મહિલા...

રસુલાબાદના લાલ ગામમાં ઝાડીઓમાંથી એક નવજાત...

ચરોતર ગેસમાંથી સીએનજી (CNG) ભરીને નડિયાદ રોડ તરફ...

મિર્ઝાપુર. જીગાના હરગઢ બજારમાં આવેલી ટોલ્સટોય...

દક્ષિણ ગુજરાતને સૌરાષ્ટ્ર સાથે જોડતા...

મિર્ઝાપુર. મિર્ઝાપુર શહેર સેવા દળના ભૂતપૂર્વ...

મિર્ઝાપુર. રાષ્ટ્રીય ક્ષય રોગ નાબૂદી...

ઐતિહાસિક નિષાદ કાજલી મેળાની તૈયારીઓ સંદર્ભે...

ડાકોરના રણછોડજી મંદિરમાં અષાઢ વદ બીજથી એક...

વડતાલ સ્વામિનારાયણ મંદિરમાં શ્રાવણી ભક્તિ...

વિંધ્યાચલના બે પાંડા વચ્ચે થયેલા લોહિયાળ...

ઔરૈયા. બિધુના કોતવાલી વિસ્તારના રુરુગંજ ચોકી...

કાનપુર ઝોનના એડીજી અને કાનપુર ઝોનના ડીઆઈજીએ...

ફતેહપુરમાં, જિલ્લા મેજિસ્ટ્રેટ રવિન્દ્ર સિંહ...

મહિલા શિક્ષણ, સુરક્ષા અને અધિકારોના રક્ષણ માટે...

પ્રાંતીય રમતગમત સ્પર્ધાનું ભવ્ય ઉદ્ઘાટન:...

ઔરૈયા. એસપી અભિજીત આર. શંકર અને અધિક પોલીસ...

ઔરૈયા. શ્રાવણ મહિનાને ધ્યાનમાં રાખીને,...

પોલીસે ગેરકાયદેસર હથિયારો સાથે વોન્ટેડ...

રાયબરેલીમાં થયેલા એક દુ:ખદ માર્ગ અકસ્માતમાં એક...

શ્રાવણ મહિનાના ત્રીજા સોમવારે પોલીસ અધિક્ષકે...

બુધવારે ફતેહપુર જિલ્લા મુખ્યાલયની કેનાલ...

ફતેહપુર. રમતગમત વિભાગ દ્વારા આયોજિત જિલ્લા...

ફતેહપુર. ઇન્ચાર્જ સહાયક નિયામક મત્સ્યઉદ્યોગે...

પ્રતાપગઢ! ઇન્ટરનેશનલ શ્રી રામ નામ લેખન બેંક...

પ્રતાપગઢ. પટ્ટી કોતવાલી વિસ્તારના રામકોલા...

પ્રતાપગઢ. પવિત્ર શ્રાવણ મહિનામાં, તહસીલના...

લખીમપુર ખીરી મુખ્યમંત્રી યોગીના આશીર્વાદથી...

લખીમપુર ખીરી ભાજપ નેતાએ પ્રભાકરન ટાયર્સના...

મંગળવારે રાત્રે ગંગા એક્સપ્રેસ વે પર ચાલતી...

વિંધ્યાચલની પવિત્ર ભૂમિ પર દક્ષિણાને કારણે...

રવાહી પુલ પર અકસ્માત: ટ્રકે બાઇક સવારનું...

લખીમપુર ખીરી ડીએમએ હાવભાવથી મનોબળ વધાર્યું,...

મૈનપુરી પોલીસ લાઇન પહોંચેલા આગ્રાના એડિશનલ...

ફતેહપુર. ઇન્ડિયન રેડ ક્રોસ સોસાયટી, આરોગ્ય...

રાયબરેલી. ઓનલાઈન ગેમ્સમાં લાખો રૂપિયા...

ફતેહપુર. નગર પાલિકા પરિષદના અધ્યક્ષ રાજકુમાર...

ફતેહપુર. બર્મતપુરમાં વહીવટી અત્યાચારો પર...

પ્રતાપગઢ. પટ્ટી નગરના રાયપુર ગામના રહેવાસી...

પ્રતાપગઢના પોલીસ અધિક્ષક ડૉ. અનિલ કુમારના...

પ્રતાપગઢ. પોલીસ વિભાગની પ્રતિષ્ઠાને કલંકિત...

પ્રતાપગઢ. સમસ્યાઓના ન્યાયી, ગુણવત્તાયુક્ત અને...

ઔરૈયા. જિલ્લાભરમાં ગુના અને ગુનેગારો સામે...

બુધવારે, ઇટાવાના ભરથાણા પોલીસ સ્ટેશન...

ઇટાવામાં પ્રાણીઓને રોગોથી બચાવવા માટે...

ભરથાણા કોતવાલી વિસ્તારના મોઢી ગામમાં એક મહિલા...

ફરી એકવાર, ઇટાવાના ઇકદિલ પોલીસ સ્ટેશન વિસ્તાર...

ઔરૈયા (યુપી). પોલીસ અધિક્ષક અભિજીત આર. શંકરના...

મૈનપુરી જિલ્લાના ભોગાવમાં, કાળા વાદળો છવાઈ ગયા...

પ્રતાપગઢ. રાણીગંજ વિસ્તારમાં શ્રાવણ...

જિલ્લા મહિલા અને બાળ અધિકારીની કચેરી, આણંદ...

औरैया। जिले भर में एसपी अभिजित आर. शंकर एवं अपर...

औरैया। श्रावण मास के मद्देनज़र जिले के प्रमुख...

पुलिस ने अवैध असलह के साथ वांछित अपराधी किया...

रायबरेली में एक दर्दनाक सड़क हादसे में एक युवक...

श्रावण के तीसरे सोमवार को लेकर थाना गोला में...

फतेहपुर में जिला मुख्यालय के नहर कालोनी में...

फतेहपुर। खेल विभाग की आयोजित जिला स्तरीय हॉकी...

फतेहपुर। प्रभारी सहायक निदेशक मत्स्य ने बताया...

फतेहपुर। बरमतपुर में हुए प्रशासनिक अत्याचार...

फतेहपुर। नगर पालिका परिषद के अध्यक्ष राजकुमार...

रायबरेली। आनलाइन गेम में लाखों रूपये गंवा देने...

मैनपुरी की पुलिस लाइन पहुंची अपर महानिदेशक...

लखीमपुर खीरी डीएम ने इशारों में बढ़ाया हौसला,...

विंध्याचल पवित्र भूमि पर फिर दक्षिणा के चलते...

रवही पुल पर हादसा: ट्रक की टक्कर से बाइक सवार...

लखीमपुर खीरी पलिया में भव्य शोरूम बनाकर शानदार...

मंगलवार की रात गंगा एक्सप्रेस-वे पर पैदल टहलते...

प्रतापगढ। पट्टी कस्बे के हनुमान मंदिर पर तहसील...

लखीमपुर खींरी मुख्यमंत्री योगी के आशीर्वाद से...

प्रतापगढ। पट्टी कोतवाली क्षेत्र के रामकोला...

प्रतापगढ। ।पट्टी में वितरित किया गया छात्र एवं...

प्रतापगढ। रानीगंज क्षेत्र के सावन शिवरात्रि...

प्रतापगढ। । पट्टी नगर के रायपुर गाँव निवासी...

पुलिस अधीक्षक, प्रतापगढ़ डॉ0 अनिल कुमार के...

प्रतापगढ। पुलिस विभाग की साख को गिराने वाले...

प्रतापगढ। समस्याओं के निष्पक्ष,...

औरैया। जिले भर में अपराध एवं अपराधियों के...

मैनपुरी जनपद के भोगांव में लगभग तीन बजे काले...

इटावा के भरथना थाना क्षेत्र के मोढी गांव में...

इटावा में पशुओं को बीमारियों से बचाने के लिए...

भरथना कोतवाली क्षेत्र के ग्राम मोढी में उस समय...

इटावा के इकदिल थाना क्षेत्र के अंतर्गत आने...

औरैया (यूपी)। पुलिस अधीक्षक अभिजित आर. शंकर के...

औरैया। जिलाधिकारी डॉ. इंद्रमणि त्रिपाठी के...

औरैया। पुलिस ने क्षेत्र में अलग-अलग...

मिर्जापुर। सोमेन बर्मा वरिष्ठ पुलिस अधीक्षक...

औरैया। भाजपा जिलाध्यक्ष सर्वेश कठेरिया ने...

इटावा में बन रहे केदारेश्वर मंदिर को लेकर संत...

भरथना कोतवाली क्षेत्र स्थित पावर हाउस में उस...

उत्तर प्रदेश के इटावा के भरथना कस्बे में एक...

मैनपुरी जनपद में भोगांव की नगर पंचायत को नगरीय...

वाराणसी: उ०प्र० जल निगम के मुख्य अभियन्ता,...

वाराणसी पुलिस कमिश्नरेट को बड़ी सफलता मिली है....

जनपद मैनपुरी में भोगांव के एकमात्र अशासकीय...

अवैध डीजल बिक्री पर प्रशासन की बड़ी...

कानपुर,दादा नगर मिश्री लाल चौराहा स्थित...

कानपुर,मुस्कान फाऊंडेशन ट्रस्ट परिवार ने अपने...

कानपुर,बी.एन.एस.डी. शिक्षा निकेतन इण्टर कॉलेज...

जनपद मैनपुरी के थाना एला क्षेत्र के ग्राम नगला...

इटावा के भरथना कस्बा स्थित मोहल्ला सती मंदिर...

इटावा में यमुना और चंबल नदियों का जलस्तर बढ़ने...

रसूलाबाद।नौहा नौगांव में सड़क पर जल भराव होने...

औरैया। जिले के बिधूना नगर स्थित जेटी गार्डन...

लखीमपुर खीरी: मूकबधिर बच्चों की स्कूल चलो रैली ?...

डीएम ने की खुरपका-मुँहपका टीकाकरण अभियान की...

कुशीनगर: समाजवादी पार्टी के कार्यकर्ताओं ने 9...

बदायूं के बिल्सी थाना क्षेत्र के परौली गांव...

औरैया जिले के दिबियापुर स्थित पीबीआरपी अकादमी...

प्रभारी चिकित्साधिकारी के निरीक्षण में...

बारिश कराने की मांग को लेकर जगह जगह पूजा पाठ...

राज्य स्तरीय इंस्पायर अवार्ड में चयनित होकर...

छितौनी इंटर कॉलेज के प्रधानाचार्य आकाश कुमार...

गरिमा महिला मंडल द्वारा ब्यूटीशियन प्रशिक्षण...

फतेहपुर। इंडियन रेडक्रास सोसाइटी, आरोग्य...

प्रतापगढ़!अंतर्राष्ट्रीय श्री राम नाम लेखन...

मिर्जापुर; सरकारी दफ्तरों में कुछ बाबू वर्षों...

मिर्ज़ापुर की रहने वाली बेटी वर्तिका केसरवानी...

ગુજરાતના મુખ્યમંત્રી 25 જુલાઈના રોજ નડિયાદ...

फर्रूखाबाद:मुख्य विकास अधिकारी अरविंद कुमार...

इटावा के भरथना थाना क्षेत्र के बृजराज नगर में...

Slug : धर्म की आड़ में धर्म परिवर्तन Place : मिर्जापुर...

શક્તિ, ભક્તિ અને આસ્થાનાં કેન્દ્ર એવા અંબાજી...

बदायूं में गौशाला की दुर्दशा को लेकर भाकियू ने...

बदायूं जिले के उझानी कोतवाली में एक हैरान करने...

रास्ते पर लग रहे खड़ंजे का ग्रामीणों ने किया...

ખંભાત તારાપુર સ્ટેટ હાઇવે રોડ ઉપર ભાટ તલાવડી-...

औरैया। सहार ब्लॉक की ग्राम पंचायत ढिकियापुर के...

औरैया। जिलाधिकारी डॉ. इन्द्रमणि त्रिपाठी ने...

जिलाधिकारी के बैठक में पर्यावरण संतुलन व...

મૃતપ્રાય ગુજરાત કોંગ્રેસમાં પ્રાણ પૂરવા...

ડાકોરના રણછોડજી મંદિરમાં અષાઢ વદ બીજથી એક...

क्या आपने कभी सोचा है कि घने जंगलों के बीच अचानक...

कुशीनगर से पीके विश्वकर्मा की रिपोर्ट.. कानून...

એક રાખડી ફોજી કે નામ' અતર્ગત સુપ્રસિદ્ધ...

कैमिकल कंटेनर पलटने से भीषण हादसा: एक की मौत, दो...

मिर्जापुर।देश में गांव गंगा और गीता का सम्मान...

फर्रुखाबाद जनपद में विभिन्न स्थानों पर जिला...

बदायूं मुठभेड़ में दो कुख्यात टप्पेबाजों के पैर...

औरैया। सावन माह की शिवरात्रि पर बिधूना कस्बे...

औरैया। थाना बेला क्षेत्र के पिपरौली शिव गांव...

कानपुर,भारतीय किसान यूनियन ने जिलाधिकारी को एक...

कानपुर। महाराजपुर थाना क्षेत्र में हाथीगांव...

सभी कर्मचारी कर्तव्यनिष्ट होकर करें जनता का...

कानपुर,कानपुर ओलंपिक संघ के तत्वावधान में यूथ...

प्रान्तीय खेलकूद प्रतियोगिता का भव्य शुभारंभ:...

लखीमपुर खीरी छोटी काशी गोला गोकरणनाथ में...

मैनपुरी जनपद में किशनी के मोहल्ला सदर बाजार...

बदाय दातागंज मार्ग पर ग्राम भैरवनगला के नजदीक...

सोनाली यूजीसी नेट परीक्षा में लहराया परचम...

30 जुलाई को कड़ी सुरक्षा व्यवस्था के बीच होगा...

पुखरायां (कानपुर देहात): पुलिस अधीक्षक अरविंद...

पौधारोपण के लिए मियावाकी विधि आज की आवश्यकता...

કરમસદ - આણંદ મહાનગરપાલિકા વિસ્તારમાં આવેલ...

प्रतापगढ़: पट्टी गोलीकांड में आरोपियों पर...

प्रतापगढ़: किसानों समस्याओं को लेकर सड़क पर...

प्रतापगढ़। ग्राम पंचायत शेषपुर आधारगंज विकास...

स्वच्छता और समाधान के संकल्प के साथ बड़खेरवा...

? डीएम की सख्ती: विकास कार्यों की समीक्षा,...

फाइलेरिया उन्मूलन को लेकर रणनीति तय लखीमपुर...

इटावा: सावन के पवित्र माह के दूसरे सोमवार को नगर...

लखीमपुर खीरी आज दिनांक 22/07/2025 को मनरेगा मजदूर...

महिलाओं की शिक्षा, सुरक्षा और अधिकारों की...

फर्जी पहचान और झांसे से नाबालिग का अपहरण, धर्म...

इटावा जिले के भर्थना क्षेत्र में आवारा सांड और...

इटावा में वरिष्ठ पुलिस अधीक्षक श्री बृजेश...

जनपद मैनपुरी में करहल थाना क्षेत्र में पुलिस...

मैनपुरी जनपद के कलेक्ट्रेट पर आधा सैकड़ा...

लखीमपुर खीरी | धौरहरा में बैंक मित्र से दिन...

*सीडीओ ने किया ब्लॉक नकहा का औचक निरीक्षण,...

लखीमपुर खीरी *पुलिस अधीक्षक खीरी संकल्प शर्मा...

मैनपुरी जनपद में भोगांव क्षेत्र के ग्राम नगला...

औरैया। जिले में चलाए जा रहे अपराधियों के...

राजपुर (कानपुर देहात)। बाजरे का बीज लेने गांव से...

इटावा जिले में यमुना और चंबल नदियों का जलस्तर...

इटावा जिले के जसवंतनगर थाना क्षेत्र के सिरहोल...

औरैया। थाना बेला क्षेत्र के सिरयावा गांव...

मैनपुरी के सामुदायिक स्वास्थ्य केंद्र पर...

औरैया। कोतवाली बिधूना पुलिस ने अलग-अलग...

इटावा लॉयन सफारी पार्क में शेरनी रूपा के तीन...

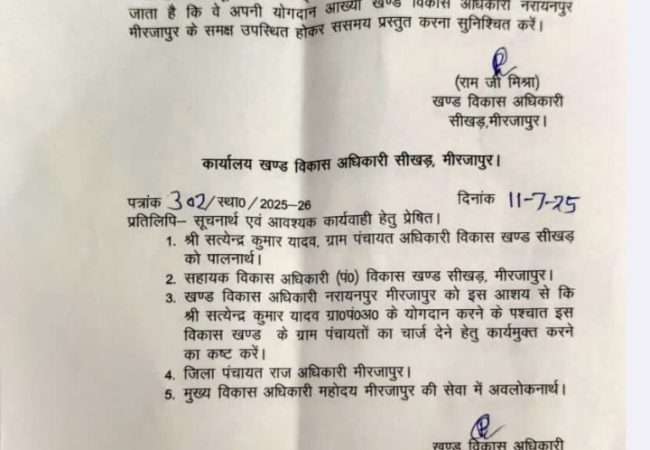

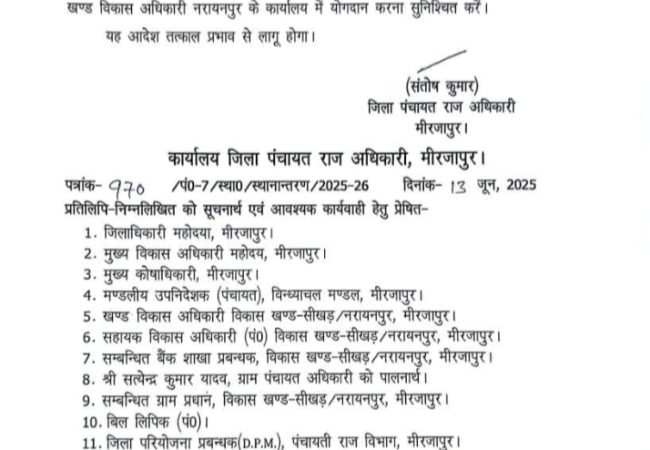

*मिर्जापुर : स्थानांतरण होने के बाद भी गांव नहीं...

इटावा में दिनांक 21 जुलाई 2025 को राष्ट्रीय...

औरैया। पुलिस अधीक्षक अभिजित आर. शंकर के...

इटावा जिले के इकदिल थाना क्षेत्र के बिरारी...

मीरजापुर। जिलाधिकारी प्रियंका निरंजन ने आज...

फर्रुखाबाद:- सपाईयो ने कलेक्ट्रेट पंहुचकर...

रायबरेली न्यायालय के सामने सड़क पर लगा भीषण जाम...

ऊमर वैश्य समाज पिछड़ी जाति में शामिल हो,समाज के...

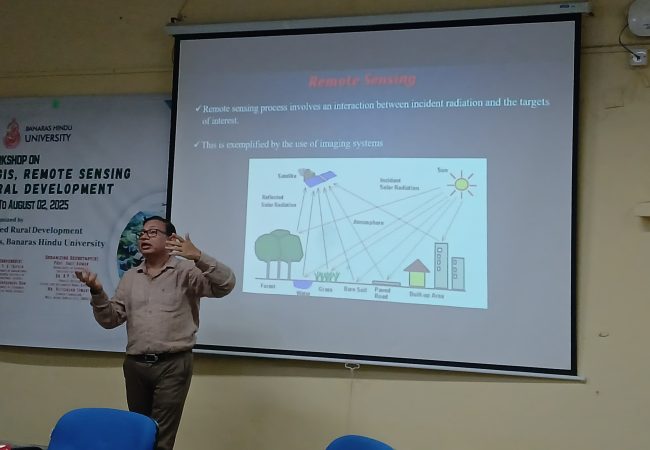

वाराणसी। भारतीय प्रौद्योगिकी संस्थान (बीएचयू),...

औरैया। राष्ट्रीय विधिक सेवा प्राधिकरण के...

ऊमर वैश्य समाज पिछड़ी जाति में शामिल हो,समाज के...

औरैया। तहसील बिधूना के श्री वनखण्डेश्वर मंदिर...

वाराणसी : जैतपुरा में बाबू सोनकर नामक व्यक्ति...

प्रतापगढ़।बेसहारा पशुओं के लिए मसीहा बना...

रसूलाबाद-बिषधन रोड पर एक व्यवसायी द्वारा 50 वर्ष...

औरैया जिले के अछल्दा कस्बे में जीएसटी स्टेट...

वाराणसी। काशी हिंदू विश्वविद्यालय स्थित...

रसूलाबाद के कहिंजरी चौकी क्षेत्र में बीते...

બી.એ.પી.એસ સ્વામિનારાયણ છાત્રાલય, વિદ્યાનગર ( APC...

औरैया। जिले के तहसील मुख्यालय बिधूना के प्रमुख...

कानपुर,आज मंगलवार को पुलिस उपायुक्त दक्षिण...

कानपुर,पुलिस उपायुक्त (मुख्यालय) एस. एम. कासिम...

जनपद मैनपुरी में किशनी विधायक इंजीनियर ब्रजेश...

मैनपुरी के जिलाधिकारी द्वारा कचहरी में आर ओ...

वाराणसी के सिगरा स्थित नगर निगम कार्यालय पर...

इमामबाड़ा निवासी मोहम्मद साजिद शेख ने कहा...

वाराणसी के चौकाघाट, अंधरापुल और नक्खीघाट जैसे...

फर्रूखाबाद,22 जुलाई 2025, जिलाधिकारी आशुतोष कुमार...

वाराणसी के जिला मुख्यालय पर कांग्रेस...

वाराणसी: सिगरा स्थित नगर निगम कार्यालय पर...

बदायूं में गांव के मैन रास्ते पर गंदगी को लेकर...

वाराणसी पुलिस कमिश्नरेट टीम को बड़ी सफलता मिली...

प्रतापगढ़। दबंग ब्लॉक प्रमुख पर 25 हजार रुपए का...

Pratapgarh. A reward of Rs 25,000 declared on the domineering block pramukh. Pratapgarh SP Dr Anil Kumar declared a reward...

हरी नगर फीडर के किसानों ने सिकंदराबाद पावर...

मैनपुरी के पुलिस अधीक्षक गणेश प्रसाद साहा ने...

A review meeting was held under the chairmanship of State Health Minister and Minister in-charge of Anand district,...

A review meeting was held under the chairmanship of State Health Minister and Minister in-charge of Anand district,...

ભાવનગર વિસ્તારમાં જોવા મળતાં કાળિયાર હરણ...

Farrukhabad: Under the chairmanship of District Magistrate Ashutosh Kumar Dwivedi, a review of the preparations of Review...

फतेहपुर। सदर तहसील के बरमतपुर गांव में...

Farrukhabad: The girl who went missing from school was found safely. After this great success of the police, people thanked...

फर्रुखाबाद:स्कूल से गायब हुई छात्रा सकुशल...

नगर की स्वच्छता व जनसुविधाओं को लेकर नगर...

बाल श्रम, भिक्षावृत्ति, बाल विवाह एवं नशा...

આણંદમાં સહકારી ક્ષેત્રે વિશ્વફ્લક પર નામના...

बदायूं के उझानी नगर पालिका का दूषित पानी रोकने...

बदायूं में विद्युत विभाग की लापरवाही आई सामने...

कानपुर देहात) सिकन्दरा थाना क्षेत्र के...

Kanpur Dehat) Near Ninhaura of Sikandra police station area, a speeding truck hit a bike rider, farmer Santosh Kumar (40) of...

Public awareness campaign launched by AHT police station to eradicate child labour, begging, child marriage and drug...

Auraiya. The nearly 170-year-old canal bridge built during the British rule in Achalda town of Tehsil Bidhuna has now...

Borsad Taluka Panchayat President Mihirbhai Patel provided an excellent example of what a leader should be. છે....

A newly married woman resident of village Puraina of Kasya tehsil area jumped into Khaprela canal on Monday morning. This...

Pratapgarh. The foundation stone of CC road was laid by Vishal Vikram Singh, representative of Nagar Palika President...

Pratapgarh. Police's campaign against vicious criminals continues in Operation Langda. Under the leadership of Pratapgarh SP...

Assam Honorable Chief Minister Dr. Himanta Biswa Sarma Expansion of Purbi Dairy Plant at Panjabari, Guwahati on July 20,...

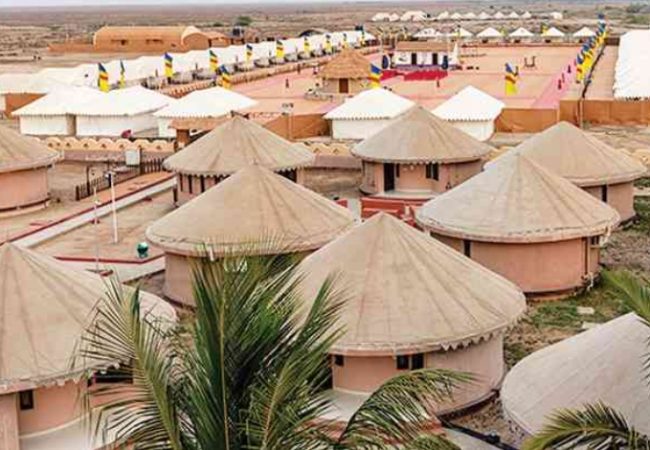

The tradition of various festivals like Kutch Ranotsav, Navratri Mahotsav, International Kite Festival and Kankaria Carnival...

Farrukhabad: People of Muslim community gave the message of communal harmony by taking out Kanwar Yatra. Also, took a pledge...

Farrukhabad: A student who left school suddenly went missing. The family members searched for her but when they could not...

Auraiya. Due to continuous rain in the area and water released from Kota, the water level of Yamuna river has started rising...

Girls become companions of health dialogue: Rotary Club conducts awareness camp Menstruation, health protection and...

Additional Superintendent of Police Kushinagar took the salute of Tuesday Parade in Reserve Police Line and inspected the...

Kanpur, Uttar Pradesh Secondary Teachers' Union Provincial President Harischandra Dixit told during the teachers' meeting...

Kanpur, On the occasion of Juloos-e-Taboot and Alam 18 Bani Hashim (AS), a free medical camp was organized in the memory of...

Kanpur, today a meeting of the Divyang Mahagathbandhan was held. In the meeting, an agreement was reached with the...

Many giant crocodiles seen in the village, one caught, search for the rest continues Report by Santosh Gupta Mirzapur. There...

Kanpur, People of Gahoi Samaj celebrated Black Day in protest against the former president. Wearing black clothes and...

BSF jawan Shashi Kumar Pandey, a resident of Nirkhi village under Jahanabad police station area of Fatehpur district, died...

Fatehpur. In view of the current challenges of water crisis and excessive exploitation of natural resources, a one-day...

Bindki, Fatehpur. The attack of a wild jackal in Bindki area has created an atmosphere of panic among the villagers....

Fatehpur. District Magistrate Ravindra Singh and Superintendent of Police Anoop Kumar Singh visited Siddhpeeth Shri...

Fatehpur. On the second Monday of Sawan, devotees kept fast and prayed to Lord Shiva in temples, praying to him according to...

A meeting was held with the ferries and cart vendors at the office of the National Ferry Track Cart Businessmen Association...

Review meeting of prosecution and e-prosecution portal concluded in Kushinagar Today, a monthly review meeting related to...

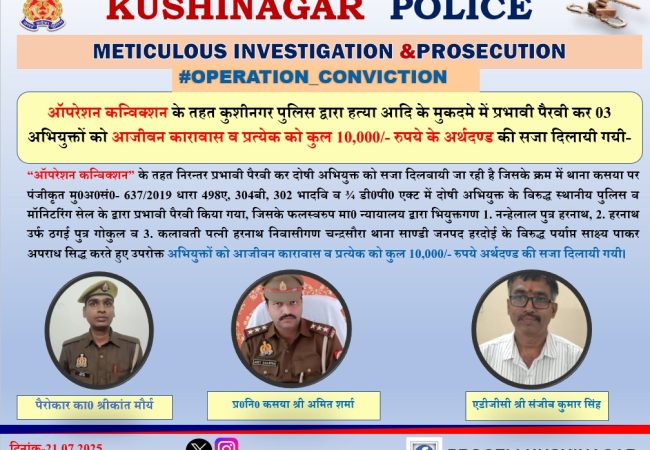

Kushinagar Police's big success, three murder accused sentenced to life imprisonment Kushinagar, 21 July 2025 — Under...

Stolen Tullu Pump Recovered, Patharwa Police Arrested Two Accused Kushinagar, 21 July 2025 — As part of the ongoing...

Additional Superintendent of Police held a review meeting at Tamkuhiraj police station, gave instructions for early disposal...

In Varanasi, the anti-corruption team has caught the Mandi Inspector red-handed taking bribe. The Mandi Inspector has been...

Kasya Police arrested 09 accused playing gambling, cash, motorcycle and mobile recovered Kushinagar, 21 July 2025 – Under...

In Etawah, under the guidance of Senior Superintendent of Police Brijesh Kumar Srivastava, all the police station...

A major success has been achieved in the joint operation of Varanasi Cantt GRP and RPF. On Monday, during checking on...

Auraiya. On Monday, a youth resident of Hamirpur Ruru village of Airwa Katra police station area has given a complaint in...

Auraiya. There is anger among children and villagers regarding the merger process in Primary School Dharampur, Vikaskhand...

Awareness about sugarcane satta demonstration: Officials gave guidelines in Gola mill Gola Gokarnath (Kheri). Now the call...

In Etawah, under the guidance of Senior Superintendent of Police Brijesh Kumar Srivastava, all the police station...

Lakhimpur Kheri CO City Ramesh Kumar Tiwari is personally present on the spot during the Kavad Yatra and is constantly...

District administration issued a statement Police took out the children locked in the school *In the Jawahar Navodaya...

Development of the region is possible only through industrial establishment- Entrepreneurs' problems should be resolved on...

Lakhimpur Kheri: Three arrested on charges of cow slaughter, arms and bike recovered Hyderabad police station arrested three...

Mirzapur. In Kalwari of Madihan police station area, a drunk youth set fire to a motorcycle parked outside the house. The...

Today, Senior Superintendent of Police Etawah, Shri Brijesh Kumar Srivastava organized a public hearing, in which the...

National President of Bharatiya Kisan Union Harpal Group, Chaudhary Harpal Singh, said at Bhogaon Tehsil premises in...

Auraiya. District Magistrate Dr. Indramani Tripathi held a meeting in the Manas Auditorium at the Collectorate with the aim...

Etawah Police conducted a special checking campaign keeping in mind the security of banks operating in the area. Under this...

In Etawah's Jaswantnagar police station area, the police took a big action and arrested four warrantees. All these accused...

Auraiya. Ganesh son of Chhotelal Dohre, resident of Ghazipur, was arrested on 21 July 2025 under the campaign being run by...

UP Bank Employees Union Mirzapur office bearers election for three years from 2025 to 2028 The following office bearers were...

UP Bank Employees Union Mirzapur office bearers election for three years from 2025 to 2028 The following office bearers were...

An awareness seminar was organized by the Ground Water Department on the occasion of Ground Water Week in the Jaswantnagar...

Wanted accused arrested in theft case Kuberstan police of Kushinagar district has arrested the accused wanted in a theft...

On 7 March 2021, Samajwadi Party National President Akhilesh Yadav performed Bhoomi Pujan for the construction of Kedarnath...

Kushinagar: 72 liters of illegal country liquor being taken to Bihar in a luxury car recovered, one arrested In a major...

71-71 Lala gang, which spread terror on social media in Kushinagar, arrested, 12 miscreants arrested with weapons...

On the second Monday of the month of Shravan, a huge crowd of devotees gathered in Shiva temples across the district in...

UP Bank Employees Union celebrated Bank Nationalization Day Report by Santosh Gupta Mirzapur. The meeting was concluded at 9...

Kanpur, Keeping in view the continuous fall in groundwater level in the state and the looming crisis on it, "Groundwater...

Kanpur, On the initiative of District Magistrate Jitendra Pratap Singh, four sewing machines were installed in the women...

Devkali temple located in Auraiya district of Uttar Pradesh is the only Shiva temple in the world, which is named after a...

Kushinagar: Body of minor missing from grave found in bushes, suspicion of black magic A sensational case has come to light...

Samajwadi Party workers have submitted a memorandum to the electricity department at Sikandarpur electricity sub-station in...

Location Kaushambi Correspondent Shravan Tiwari Horrific conspiracy to kill in-laws, sulphas mixed in flour, wife, father...

About 10 wires on 33 thousand high tension poles going to Gidaha sub station of Kaptanganj tehsil area have disappeared,...

There is an outcry among the farmers regarding fertilizer due to non-availability of fertilizer from dozens of cooperative...

On the second Monday of Shravan month, a different kind of gaiety was seen in the Shiva temples. In this scorching heat, the...

Municipal Commissioner Akshat Verma inspected Ravindrapuri, directed to run encroachment and liquor shops worth ₹10,000...

Kheda district in-charge Minister Hrishikesh Patel visited the district today. He held a review meeting at the Collector's...

Kheda district in-charge Minister Hrishikesh Patel visited the district today. He held a review meeting at the Collector's...

A horrific accident took place on Monday afternoon on the Ahmedabad-Vadodara NH48 near APMC on the outskirts of Pipalg...

Under the leadership of Mainpuri's Chief Medical Officer Dr RC Gupta, the team visited the schools of Bhogaon and inspected...

In Ruknpur village of Jaswantnagar tehsil of Etawah, the four bigha millet crop of farmer Ajay Yadav was deliberately...

Children and villagers are forced to walk on the muddy road in village Vairpur Manpur of Dahgawa area of the district...

Three smugglers were arrested with more than 20 kg of doda peel in Alapur police station of Badaun. Police arrested Kabir,...

In Badaun, a teenage cyclist died after being hit by a speeding bike. The accident took place in Jakhora Joharpur village of...

On the second Monday of Sawan, a six-member group of Kanwariyas who reached Bhayanaknath temple in Kudarkot town of Bidhuna...

Bhagya Singh (35), a resident of Hardu village in Bela police station area of Auraiya district in UP, died during treatment....

Bhagya Singh (35), a resident of Hardu village in Bela police station area of Auraiya district in UP, died during treatment....

The work of Pradhan Mantri Awas Yojana was being done by JCB on the vacant plot of Harish, a resident of village Sahara in...

Mirzapur. Nagar Palika President Shyamsundar Keshari held a review meeting with the officials of health and tax department...

Mirzapur. In Songarha village of Halia police station area, a woman had set herself on fire by pouring flammable substance...

Etawah Senior Superintendent of Police Mr. Brijesh Kumar Srivastava organized a public hearing in the police office. In the...

Mirzapur. Vindhyachal police station exposed an active gang involved in theft and snatching. 7 accused including 2 minors...

In Varanasi, on the second Monday of Sawan, Yadav brothers from Seer Govardhan performed Jalabhishek at Vishwanath Temple...

In Varanasi, on the second Monday of Sawan, Yadav brothers from Seer Govardhan performed Jalabhishek at Vishwanath Temple...

A mega oil palm plantation drive was organized under the "National Mission on Edible Oils Oil Palm" at Sarol village in...

Kanpur, In the famous Baradevi temple premises, with the infinite grace and blessings of Maa Baradevi, like every year, the...

Roads and Building (Panchayat) Department, Kheda-Nadiad has undertaken extensive repairs of roads damaged due to rain during...

On the second Monday of Sawan in Auraiya, UP, a huge crowd of Shiva devotees reached Devkali temple and performed...

Bank of Baroda has been operating on Station Road in Petlad city for years, whereas Dena Bank, which was operating for...

The district office of Sanatan Hindu Vahini, formed for the promotion and protection of Sanatan Dharma in Auraiya, was...

Under the guidance of Anand District Collector Shri Praveen Chaudhary, the investigation team of the Assistant Geologist's...

Kanpur, In view of the second Monday of Shravan month, Joint Commissioner of Police (Law and Order) Ashutosh Kumar inspected...

Fatehpur,,, District Election Officer Ravindra Singh informed that Special Intensive Revision-2025 campaign is being...

Young man tied to a pole and beaten to death, young man kept begging for mercy, village turned into a cantonment due to...

Etawah police has arrested 4 members of an organised gang involved in cyber fraud through interstate online gaming....

The police took action under Operation Shikanji campaign being run by Mainpuri's Superintendent of Police Ganesh Prasad...

Auraiya. Rakesh Kumar Rajput (40) consumed poison after a quarrel with his wife in Nagla Bhagat village of Achalda police...

Kanpur Dehat Shivli. The state government organizes Mukhyamantri Arogya Mela every Sunday in every primary health center....

Auraiya. In Sirkharna village of Ayana police station area, due to a land dispute, a group attacked the village farmer...

Saraswati Vidya Mandir immersed in the beauty of Shravan month, organized Teej Special Bagless Activity Lakhimpur Kheri On...

Varanasi: Bhelupur police has got a big success. Police has arrested a wanted accused from near Assi Nala. Gold chain, cash...

The body of Naina, 8-year-old daughter of Satendra Tiwari, resident of village Kakawai in Karhal police station area of...

Kanpur Dehat. There was a stir in village Baliapur of Thana Mangalpur area when after a minor altercation, a youth sitting...

Kanpur Dehat. There was a stir in village Baliapur of Thana Mangalpur area when after a minor altercation, a youth sitting...

Ayodhya: Two youths caught dressed as beggars with Muslim attire and Hindu Aadhar card. The villagers, on suspicion, caught...

* Body of a youth found stuck in the canal, villagers informed the police. Body of a youth found stuck in Kishundaspur...

District Magistrate Satyendra Kumar conducted a surprise inspection of the mental hospital on Sunday and reviewed the...

Anupam Yadav, a resident of Mohalla Gandhi Nagar, Bhogaon, Mainpuri district, has said in the complaint given to the police...

The 75-day ward stay and cleanliness campaign was inaugurated in Varanasi city south assembly constituency on Sunday. Former...

Health and Family Welfare Department State Government. Former Union Minister and MP Shri Devsinh Chauhan laid the foundation...

Etawah police has busted an interstate gang involved in cyber fraud under the guise of online gaming. Police arrested four...

Farrukhabad: The enthusiasm of the Kanwar pilgrims during the month of Saab is worth seeing. Har Har Mahadev chants can be...

Fatehpur: In Mohankheda village of Malwa police station area, a mob tied a young man to a pole and beat him brutally on...

*Youth of Palia Kalan Kheri arrested in Nepal with brown sugar* *Big news from Lakhimpur Kheri from intelligence sources...*...

Lakhimpur Kheri – Police Station Mailani took tremendous action, robbery of 12th July was exposed Two vicious robbers...

Lakhimpur Kheri – Police Station Mailani took tremendous action, robbery of 12th July was exposed Two vicious robbers...

At Karhal crossing of Kotwali area of Mainpuri district, pickpockets stole 12 kg silver from bullion traders. Jitendra alias...

LPG cylinder caught fire while making tea in Badaun, video of the fire went viral Villagers tried to extinguish the fire for...

Under the banner of Ek Ped Maa, on Sunday, the workers of Gadhdhari Sena took a pledge to make Kashi clean and beautiful by...

After a picture went viral from Asauthar police station premises in Fatehpur district of Uttar Pradesh, there has been a...

Around 109 small and big bridges built on the road in Anand district have been inspected. At that time, work including...

Auraiya. Under the intensive campaign being run against criminals, under the guidance of Superintendent of Police Abhijeet...

Wife poisoned husband: After being caught with lover, she mixed poison in water and made him drink it, admitted in hospital...

Farrukhabad: - In the accident, driver Sandeep, son of Ramesh Chandra, resident of village Yakutganj from Kotwali Fatehgarh...

In Shastri Nagar Colony, Dalit woman Manju Devi Gautam was beaten up by goons. The victim has demanded action against the...

Shilpi, wife of Atul, resident of village Durjanpur of police station Ochha in Mainpuri district, hanged herself to death in...

Married lover ran away with lover taking in-laws' jewellery This is from Kodarwar village under Sultanpur Ghosh police...

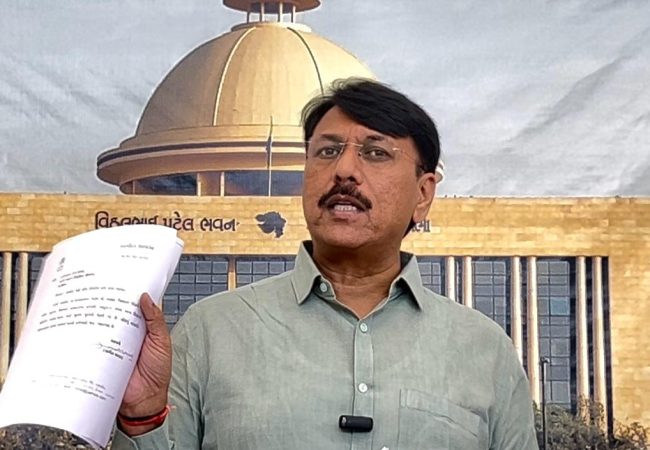

In a press conference at the Gujarat Legislative Assembly, Congress Party leader Shri Amitbhai Chavda said that for the last...

In a press conference at the Gujarat Legislative Assembly, Congress Party leader Shri Amitbhai Chavda said that for the last...

Anand Amul Dairy increased the price of buffalo milk per liter from Rs. 51.74 to Rs. 63.53 in 2021-22, an increase of Rs....

Lakhimpur Kheri The government and administration have made strict arrangements for the security of the devotees in Gola...

Farrukhabad: Gangster Anupam Dubey's troubles are not showing any signs of decreasing. Property worth Rs. 3 crore 10 lakhs...

Varanasi: Rohania MLA Dr. Sunil Patel inaugurated the Vidyut Seva Maha Abhiyan Mega Camp organized on Saturday at the...

Varanasi: Youth Spiritual Summit-Drug Free Youth" program was organized at Rudraksh Convention Center, Sigra. "Kashi...

Varanasi: Youth Spiritual Summit-Drug Free Youth" program was organized at Rudraksh Convention Center, Sigra. "Kashi...

In Fatehpur, a seminar was organized at the Congress office Jwalaganj under the joint aegis of the District and City...

Fatehpur. Villagers reached the collectorate with a complaint that some people of the village were operating a wood depot by...

Fatehpur. Today, the Kotwali police arrested the woman friend of the main accused in the case of the murder of a young man...

Fatehpur. Today, the Kotwali police arrested the woman friend of the main accused in the case of the murder of a young man...

Kanpur Dehat. A fertilizer inspection campaign was conducted in Derapur area on the instructions of the government to...

Mirzapur. An important meeting was organized by All India Brahmin Ekta Parishad in Hotel Spring located in Bajirao Katra of...

Devotees of Auraiya district have started the first 470 km long Kanwar Yatra from Haridwar to Kudarkot. This yatra is being...

Kanpur, today under the ambitious scheme of our Prime Minister and Chief Minister - "Empower Mother & Baby", "Sampoorna CME"...

Senior Superintendent of Police Etawah flagged off 10 new four-wheelers for police stations today to make the services of UP...

Surajnagar market area resounded with Har Har Mahadev Dozens of devotees from villages like Punn Chhapra, Khajuria,...

Preparations for the huge Kavad Yatra organized by All India Hindu Mahasabha and Jai Bhole Baba Committee are complete....

In a major action, the Anti Corruption Team arrested 3 persons red handed while taking bribe. Three employees of Varanasi...

In Nagla Radhe Moja Banamai village of Bharthana area, two parties came face to face over an old dispute. Sticks were used...

Villagers of Mirgaon have to travel 10 kms every day for treatment, serious allegations against CHO Kanpur Dehat, Sikandra...

Mirzapur. District Magistrate Priyanka Niranjan inspected the under construction Maa Vindhyavasini University. The District...

Naurangiya's son becomes Para Commando, village gives grand welcome to the brave son By getting selected in the most...

Colourful competitions based on rainy season concluded Auraiya. Various competitions related to rainy season were organized...

Relief to farmers due to prompt action of administration on irrigation crisis in Vishunpura area The long-standing...

There was a stir in Bharthana area of Etawah district when a flour mill shopkeeper died on the spot due to electric shock....

During the Sampoorna Samadhan Diwas organized in Jaswantnagar Tehsil, the attitude of the District Magistrate was seen to be...

Mirzapur. Katra police station has arrested the accused of misbehaving and forcibly raping a woman. The victim woman had...

Asking for money for alcohol proved costly, wife killed husband by beating him with a stick A heart-wrenching incident has...

The meeting of the District Coordination and Grievance Committee was held at Anand Circuit House under the chairmanship of...

Auraiya. Taking action in various cases, Kotwali Bidhuna police has arrested a total of 9 accused and taken legal action...

Farrukhabad:- A member of Gau Rakshak Dal is missing since 4 days but the police is not listening to the plea of the family....

Mirzapur. The fear prevailing for 48 hours due to the poisonous snake hidden in the house vanished in 10 minutes. After...

Two youths died in a collision with an unknown vehicle near the Bhewan Ramganga Canal Road Mazar in Shivli police station...

Complaint of substandard drain construction in Samadhan Diwas. Allegations of violation of standards have come to light...

Shivli, Kanpur Dehat. A farmer who was filling water in the fields from a water tank to transplant paddy saplings was bitten...

After the death of a person resident of Rajau Asalatganj of Rasulabad tehsil area, the Lekhpal transferred the land in the...

In the Shramana training camp being conducted at the YBS Centre in Jasrajpur village of Bhogaon district Mainpuri, the monks...

High-tech boundary wall, museum and lighting plan worth Rs 45 crore finalised in Ram Mandir premises. Ram Mandir Nirman...

Mirzapur. Today, a fight broke out between some Kanwarias on platform number one in front of the booking office at the...

Auraiya. A medical assessment camp was organized for disabled children in BRC Auraiya, in which 62 children from various...

*Major action on fertilizer shops: one sealed, one license suspended, notice to many* *Samples taken for quality check, raid...

Honorarium stopped due to negligence, serious negligence came to the fore in center operation and following instructions....

23 year old Sonam, wife of Jitendra Singh, resident of Nagla Rate village of Karhal police station of Mainpuri district was...

Farmer's file missing from SDM office: Woman wandering for justice for 15 months, farmer union officials are protesting....

In the course of the special enforcement campaign being run in Fatehpur district on the instructions of the Excise...

Beautification of Sant Ravidas Park, children will be introduced to the biography of Ravidas ji Varanasi: Sant Ravidas...

In Radhanagar police station area of Fatehpur, a wife tried to poison her husband. Hrithik Yadav and Sushila Yadav were...

Location Kaushambi Reporter Shravan Tiwari Village Development Officer found guilty in Block Development Officer's...

Location Kaushambi Correspondent Shravan Tiwari School bags distributed to children in Primary School Birner on the...

A complete solution day was organized in Kuravali tehsil of Mainpuri district. District magistrate Anjani Kumar and...

Lakhimpur Kheri “Sampoorna Samadhan Diwas” was organized at each tehsil level of the district. District Magistrate...

An ambitious plan is being prepared with the aim of accelerating the development of Kanpur city and reducing the increasing...

The administration has taken major action against illegal encroachment in Malupur of Gram Panchayat Dharamgandpur of...

Samajwadi workers have started a special padyatra from Etawah. The purpose of this 900 km long padyatra is to bring Akhilesh...

A lineman died a painful death after coming in contact with an 11,000 volt line in Bilampur village of Ikdil police station...

A grand Sanatan Yatra was organized under the aegis of Shivshakti Akhara in Nagar Panchayat Asauthar of Fatehpur district....

Renowned doctor Dr. V.B. Dhuria seriously injured in road accident Sidhauli (Sitapur). The sad news has been received that...

A meeting was held in the auditorium of Mainpuri's Reserve Police Line under the chairmanship of Area Officer Santosh Kumar...

Auraiya. The video of theft of lakhs of rupees from the house of a businessman in Kiratpur of Bidhuna police station area of...

Kanwariyas were given a grand welcome, Nagar Palika President Ira Srivastava showered flowers Lakhimpur. Kanwariyas who went...

In Kanbhaipura Gram Panchayat of Anand taluka, wife Parulben Vinubhai Thakor was elected as Sarpanch. While in the Up...

The Hindola festival has started in the Ranchhodji temple of Dakor for a month from Ashadh Vad Bij. During this month,...

The foot market opposite the railway station in Anand has turned into a dilapidated condition. When the report was...

A tablet distribution program was organized at Sugriv Singh Memorial Institute of Paramedical Sciences and Nursing College...

Mainpuri District Magistrate Anjani Kumar Singh took stock of the problems related to the Kanwar Yatra route during the...

Review meeting of development works in Mohammadi Tehsil, absence of many departments felt Mohammadi, 19 July. A review...

Participants showed their skills in the dress and bag competition, winners were honored. Prize distribution ceremony...

ABVP Lakhimpur's Phoolbehad city unit workers ran a membership campaign Akhil Bharatiya Vidyarthi Parishad Lakhimpur...

On 19-07-2025, a meeting of the Members of Parliament Road Safety Committee was held in the Collectorate Auditorium,...

Death of Mathana Dham's Amarnath Baba Lakhimpur Kheri. In the holy month of Shravan, a very sad news has been received from...

Kanpur, Today on Saturday, District Magistrate Jitendra Pratap Singh participated in the Sampoorna Samadhan Diwas organized...

There is a lot of anger among the villagers of Karamsad village after the state government's decision to declare Anand a...

Thieves broke the lock of Shri Jawaharlal Nehru Secondary School located in Kheda Buzurg village of Thana Jaswantnagar area...

Youth Spiritual Summit Nasha Mukt Yuva for Vikasit Bharat program was organized at Varanasi's Banaras Railway Station....

Varanasi: Thieves broke into the closed house of former veterinary officer Dr Aditya Narayan Upadhyay, who had built a house...

Varanasi: During the Kanwar Yatra, lakhs of people travel together, and in such a situation the importance of cleanliness...

Karamsad- Under the instructions and guidance of the Commissioner of Anand Municipal Corporation, the roads damaged due to...

The rains had taken a break in Gujarat for the last few days. However, now the rains have decided to come back. Heavy rains...

Farrukhabad: Due to stress, the son of a Pradhan hanged himself and ended his life. Police took the body into custody and...

The traffic police in Etawah launched a commendable campaign to promote road safety. On the instructions of Senior...

Location Kaushambi Correspondent Shravan Tiwari 20 thousand looted from a grocery shopkeeper in broad daylight in Kaushambi,...

Kanpur: Divine Angels Group organized a Shiv dedicated Saavan program in Pind Balluchi restaurant located in Arya Nagar, in...

Nazia (26 years), a resident of Mohammadpur village of Block Bhitora of Fatehpur district, had called 102 ambulance when she...

Hathgam, Fatehpur. Prior to the Foundation Day of Bank of Baroda, which has achieved top most achievements in the rural area...

Bindki, Fatehpur. Two groups of farmers clashed over tying a ridge in the field. Four people including a woman farmer were...

Government's big step regarding women's safety, now it is mandatory for the driver to write his name, Aadhaar and mobile...

Kanpur, a cunning smuggler from Bihar, who was waiting for a train to go home, was arrested with 3 kg 900 grams of hashish...

Kanpur Nagar In view of the state-wide decline in groundwater level and the seriousness of the crisis arising on it, the...

Along with comfortable travel, food and beverage facilities are being expanded at Kanpur Metro stations, tender issued for...

Kanpur, Today at Green Park crossing, the sector in-charge made people aware of traffic rules. People were told not to drive...

Auraiya. Under the direction of Superintendent of Police Abhijit R. Shankar, all the station in-charges of the district...

Fatehpur- Superintendent of Police Anoop Kumar Singh conducted a surprise inspection of the Cyber Crime Police Station of...

Auraiya. On Friday, District Magistrate Dr. Indramani Tripathi held a quarterly review meeting of the District OTD (One...

Auraiya. Fireman Gaurav Kumar Shakya of the fire department set an example of honesty by returning a mobile phone found on...

Fatehpur. In the monthly meeting of Bharatiya Kisan Union (Tikait) Kisan Mazdoor Mahapanchayat, the issue of dilapidated...

More than half a dozen hand pumps are lying defunct in Brahmin village of Ajanpur Indauti Gram Panchayat of Rasulabad...

Thieves raided a secondary school located in the police station Jaswantnagar area of Etawah district last night and stole...

Rasulabad Priya Tiwari, wife of Akshay Tiwari, resident of Narkhas, told the police in a written complaint that her neighbor...

District Magistrate of Mainpuri Anjani Kumar Singh today conducted a surprise inspection of the Government Library. During...

Auraiya. As per the instructions of the government, Sampoorna Samadhan Diwas is being organized on the first and third...

Gram Pradhan representative Satendra Kumar sent off the Kanwariyas by applying Tilak on them. Rasulabad Kanpur Dehat. In the...

Auraiya. On Friday, District Magistrate Dr. Indramani Tripathi reviewed the development works and schemes through a zoom...

Police received information from Bhogaon village Jeevanpur Barauli in Mainpuri district that an unknown person ended his...

A meeting of the Block Education Officer Association of Kanpur Dehat unit was called unanimously. In the meeting, the old...

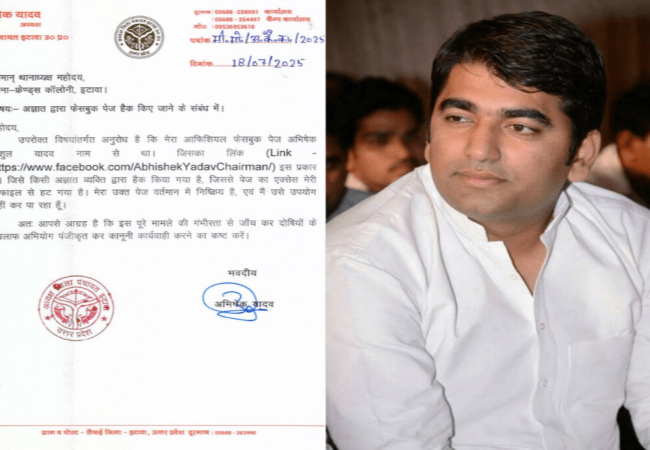

In Etawah, the official Facebook page of Samajwadi Party national president Akhilesh Yadav's cousin and district panchayat...

Mainpuri's Chief Medical Officer Dr RC Gupta inspected the special cleanliness campaign regarding the special communicable...

District Magistrate gave instructions for compliance of rules, prompt disposal and installation of information boards Kanpur...

Vaibhav Pandey, a resident of Kanpur, is a resident of Benajhabar Colony. With his hard work, he succeeded in JEE Advanced...

Auraiya. On Thursday, teachers and students of Axis Public School located in the town of Phaphund planted trees in the...

For the last five days, women have been protesting outside the liquor shop in Ghasiari Tola, Durgakund, Varanasi. Dozens of...

Varanasi. The monthly review meeting of the District Health Committee Governing Body was held on Saturday in the...

Kishani police has taken major action under Operation Shikanja campaign being run by the Superintendent of Police of...

Eastern State President Vipin Tiwari handed over the nomination letter to Rasulabad Block President Ranveer Yadav of...

।। Amrit Bharat train was welcomed by MP with flower garlands।। When the new Amrit Bharat Motihari to Anand Vihar...

There is an outcry among the farmers for urea fertilizer. Urea is missing from the committees. In such a situation, 220 bags...

Students are getting troubled by waterlogging and garbage at the school gate Due to the accumulation of rainwater and...

The financial assistance announced by the state government was distributed to the families of the deceased in the Gambhira...

Location Kaushambi Correspondent Shravan Tiwari Mobile number 9628443364 *Snake bites woman grinding masala on grinding...

Due to heavy rain on Thursday night, the roof of a kutcha house collapsed in Patel Nagar of Bakewar town of Etawah, due to...

Auraiya. On July 17, a joint police team of Thana Bidhuna and SWAT arrested two drug smugglers during checking on...

A meeting was held with the elite citizens and traders of the district in the Police Line auditorium of Mainpuri district....

Auraiya. In Tilak Nagar market of Bidhuna town, at around 2 o'clock in the night, lightning struck a battery shop, due to...

Special meeting held to ensure participation of ex-servicemen in city development Lakhimpur Kheri. A special meeting was...

Samajwadi Party condemns police brutality in Sankarpur Bhadura Lakhimpur Kheri, 16 July 2025. A situation of chaos arose...

Advocates of the civil court of Mainpuri district reached the District Magistrate's office to demand the resumption of the...

There was a stir at Ganga Barrage in Kanpur when a youth from Pawa in Unnao suddenly jumped into the barrage from gate...

Eastern State President Vipin Tiwari was present in the Kisan Kharif seminar in Kanpur Dehat on behalf of Bharatiya Kisan...

Kanpur, Deputy Commissioner of Police (South) Dipendra Nath Chaudhary conducted a public hearing at his office. During the...

According to the information received, Santosh Yadav (42) son of Deshraj, a resident of Saran village of Moth police station...

According to the information received, Santosh Yadav (42) son of Deshraj, a resident of Saran village of Moth police station...

Among the various festivals in Indian Hindu culture, Chaturmas holds great importance. One of the festivals that falls under...

Kotedaar Amit Kumar of Gundela village of Rasulabad did not give ration to the card holders from April to June. He made the...

The meeting of the Governing Body of the District Health Society was held at the Collector's Office, Anand under the...

Devendra Singh Kataria, an advocate of the District and Sessions Court of Mainpuri, has sent a memorandum to the Chairman...

A mega camp was organized on the second day of the three-day camp being run at the Executive Engineer's office in Mainpuri...

Janakshree Devi (30), a woman Panchayat member of Samajwadi Party, died due to electric shock in village Udhanpura of Ikdil...

In Rahatpura village of Bakewar police station area of Etawah, a daughter-in-law, along with her father, beat up her...

Fatehpur Toll Ghotala: A huge scam has been exposed at Jindpur toll plaza situated on Banda-Tanda road in Fatehpur district...

Fatehpur Toll Ghotala: A huge scam has been exposed at Jindpur toll plaza situated on Banda-Tanda road in Fatehpur district...

Fatehpur Toll Ghotala: A huge scam has been exposed at Jindpur toll plaza situated on Banda-Tanda road in Fatehpur district...

In Badayun, two sides clashed over an old rivalry and sticks were used. The video of the fight went viral on social media....

A roadways bus and an ambulance collided violently in Badaun, a major accident was averted. The ambulance went out of...

Auraiya. In Kiratpur village of Bidhuna police station area, thieves stole cash worth about two lakh rupees from a...

Fatehpur. In the sequence of Chief Minister Yogi Adityanath's decision to close schools, a case of primary school Bhatpurwa...

Fatehpur- The weather became pleasant due to the rain after many days. People got relief from the humid heat, while on the...

*Fatehpur: Contract for construction of drain in Naveen Market again given to the same contractor* These days, the work of...

Farrukhabad: (Rajepur) Family members of a businessman, who was not found for three days, blocked the Etawah-Bareilly...

Farrukhabad: (Rajepur) Family members of a businessman, who was not found for three days, blocked the Etawah-Bareilly...

On 28th June, the body of an 8 year old girl was found in a field near village Alipur Kheda in Bhogaon police station area...

The Commissioner of Anand Municipal Corporation has formed 15 teams to inspect the structures of the municipal buildings in...

In Etawah, Senior Superintendent of Police Brijesh Kumar Srivastava took the salute and inspected the weekly parade at the...

District:- Farrukhabad Report:- Varun Dubey Anchor- The accused of rape and murder of an 8-year-old girl in Farrukhabad was...

Farrukhabad: A youth died after being hit by a train. On receiving information, police reached the spot. The body could be...

In Badaun, four people kidnapped a 13-year-old minor girl from her home and gang-raped her. A 13-year-old minor girl...

Auraiya. A major accident was averted near Diwhara village on Bidhuna-Kishni road under Erwakatra police station area of...

48 year old Bhoop Singh Shakya, resident of village Khadepur of Kishani in Mainpuri district was sleeping on the roof of his...

Karamsad - The Commissioner of Anand Municipal Corporation has asked to catch the animals roaming on public roads in the...

A meeting of the state cabinet was held in Gandhinagar under the chairmanship of Chief Minister Bhupendra Patel. Giving...

Under the 'Good Morning Mainpuri' campaign being run by Mainpuri's Superintendent of Police Ganesh Prasad Saha, the police...

Kanpur. Allen Career Institute, the country's leading coaching institute, inaugurated Talentex 2026 at its Kanpur center. On...

In Kanpur Dehat, Bhognipur police station has arrested the miscreant who committed robbery on bike riders on Wednesday...

Farrukhabad:- The village's strong Yadavs seriously injured a girl from Shakya community over the issue of field embankment....

Kanpur, who does not feel sad to see the young generation in our society moving towards addiction? Unfortunately, this evil...

Kanpur, Deputy Commissioner of Police (South) Dipendra Nath Chaudhary held a meeting related to IGRS. Officers and employees...

In Bahbalpur village of Thana Mangalpur area of Kanpur Dehat, thieves targeted two houses at night and stole cash and...

Sikandra (Kanpur Dehat) Local people have started coming out openly against the famous Surya Dhaba of Sikandra and the...

The condition of the secretariat in Thanhamirpur Gram Panchayat of Rasulabad development block is worrying. Only walls are...

Benipur Gaushala has become an example of hell, four dead cows are rotting amidst the filth, villagers are angry due to the...

Shivli, Kanpur Dehat. In the National Icon Award 2025 organized by the Ministry of Defense, Government of India at the Prime...

Shivli, Kanpur Dehat. In the National Icon Award 2025 organized by the Ministry of Defense, Government of India at the Prime...

Shivli, Kanpur Dehat. In the National Icon Award 2025 organized by the Ministry of Defense, Government of India at the Prime...

Kanpur Dehat Shivli. Ramadhar son of late Chhabi Nath Gautam, resident of Sunvarsha Maitha railway station of Shivli Kotwali...

The Gram Panchayat Secretary had issued a show cause notice to Rozgar Sevak Sobran Singh on July 7 for not getting the tree...

In Rasulabad Nimbhu village, 25 KVA electricity transformer is out of order for the last one month. Due to this, villagers...

The condition of the Government Veterinary Hospital located in Kursi Kheda village of Rasulabad tehsil area of Kanpur has...

The condition of the Government Veterinary Hospital located in Kursi Kheda village of Rasulabad tehsil area of Kanpur has...

The transport department team raided Rasulabad town at 5:30 pm. On seeing the team, many drivers left their buses and...

An important meeting was organized to promote women empowerment in Rasulabad development block under the National Rural...

Farrukhabad Block Mission Manager beaten with slippers. Beaten while holding a group meeting in the block. A woman from the...

Kanpur, A joint team of Thana GRP Kanpur Central and RPF achieved a major success late Thursday night and arrested a youth...

Kanpur, District Divyangjan Empowerment Officer is organizing an important camp for Divyang children, the objective of which...

Kanpur, Colonelganj police has arrested an interstate ganja smuggler. 19.926 kg of illegal ganja was recovered from the...

Kanpur, Taking an important step towards the social empowerment of construction workers, the Kanya Vivah Sahayata Yojana is...

Farrukhabad 15 days ago in Farrukhabad district, after a police constable was accused of raping a minor, on the order of the...

Kanpur, the victim appealed to the police commissioner for justice. Let us tell you that Anil Singh, who is a resident of...

Young man jumps from house during Haryana Police raid, dies during treatment Auraiya. Haryana Police raided the house of...

Mainpuri's district magistrate Anjani Kumar Singh himself visited the spot and inspected the shops selling country liquor...

Negligent teacher suspended, action taken on electricity problem of smart class. CDO conducted surprise inspection of two...

Important organizational changes have been announced in the Gujarat Pradesh Congress Committee. The Congress high command...

On the fourth day of the five-day FLN training being conducted at Bhogaon DIET in Mainpuri district, DIET Principal Dr...

23-year-old Resu alias Munshi from Adarsh Nagar South of Bakewar town of Etawah went missing under mysterious circumstances....

In Etawah city, in broad daylight, a young man posing as a policeman duped an old man of Rs. 4,500. Mukhtar Mohammad of...

In Etawah city, in broad daylight, a young man posing as a policeman duped an old man of Rs. 4,500. Mukhtar Mohammad of...

In Mainpuri district, the tonsure ceremony of the people who had come to the Shramner camp being held at the YBS Centre in...

Uttar Pradesh Rural Journalist Association provided financial assistance to the family of late journalist JP Mishra...

In Etawah's Saifai police station area, police, SOG and surveillance team have arrested two fake SDMs in a joint operation....

Auraiya. A dumper returning after unloading goods from Malhousi village under Bela police station area of Bidhuna tehsil...

Mainpuri's Superintendent of Police Ganesh Prasad Saha organized a meeting on crime control in the police line. All the...

The police has taken major action under Operation Shikanja campaign being run on the instructions of the Superintendent of...

In Kishani of Mainpuri district, unafraid of the police, miscreants created a ruckus at Kishani intersection. The car riders...

Farmer Greesh Chandra had gone to the Bank of India branch located at Kusmara in Mainpuri district to deposit money in his...

In Badaun district, people demonstrated demanding replacement of dilapidated electricity pole. Allegations of no hearing...

Smuggler arrested with smack worth Rs 30 lakh in Dataganj of Badaun district, 155 grams of smack, illegal knife and Rs...

Auraiya, 17 July 2025. District Magistrate Dr. Indramani Tripathi visited village Shikharna of Tehsil Ajitmal under Mission...

Auraiya. District magistrate Dr. Indramani Tripathi conducted a surprise inspection of the cow shelter located in village...

In Mainpuri district, traders protested fiercely under the leadership of Kishini Nagar President Danny Yadav. Let us tell...

BJP leader Riya Shakya listened to the problems of the people, assured of quick solution Auraiya. Former BJP Vidhan Sabha...

DM took stock of the rising water level, instructions for safety Auraiya, 17 July 2025. District Magistrate Dr. Indramani...

Auraiya. District Magistrate Dr. Indramani Tripathi inspected the Gram Panchayat Itha of Bhagyanagar development block under...

Auraiya. District Magistrate Dr. Indramani Tripathi inspected the Gram Panchayat Itha of Bhagyanagar development block under...

The advocates of the civil court of Mainpuri district united and reached the court premises to demand the resumption of the...

Auraiya. Under the mediation campaign started by the District Legal Services Authority Auraiya on July 1 on the instructions...

There was a stir on Thursday evening in the incomplete petrol tank complex located in Khajuria village of Nebua Naurangia...

The police has taken action under Operation Shikanja campaign being run by the Superintendent of Police of Mainpuri...

Pensioners staged a sit-in protest against pension amendment, submitted a memorandum Auraiya. A sit-in was held at Kakor...

The encroachment that has been spreading for years in the village council Sirsia Kala of Padrauna tehsil has now taken a...

Awareness camps organized on CSC Day, people participated enthusiastically in teleconferencing Auraiya. The 16th CSC Day was...

Horrific road accident in Kushinagar: Two bikes collide head-on, two killed, two injured A tragic road accident took place...

In Kushinagar district, when politicians shower promises from the stage, then former Block Pramukh of Vishunpura Amit...

There was a stir in the area when the body of a 24-year-old newly married woman was found hanging from a noose in Tola...

Auraiya. Two bikes collided heavily near Gali Mod on Bidhuna road in Bela police station Bela area of the district. One...

Auraiya. Two bikes collided heavily near Gali Mod on Bidhuna road in Bela police station Bela area of the district. One...

Farrukhabad The condition of five children deteriorated due to food poisoning. A girl died due to food poisoning. Four...

After the payment of farmers' dues, the exercise to run the mill intensified The Kanodia sugar mill of Kaptanganj, which was...

Congress MP and Leader of Opposition in the Lok Sabha Rahul Gandhi on Thursday accused the Election Commission of supporting...

The Karnataka government has submitted a report to the High Court in the case of the stampede that took place during the...

The only petrol pump in Pipra Bazaar has become a cause of trouble for the residents of the area these days. People are...

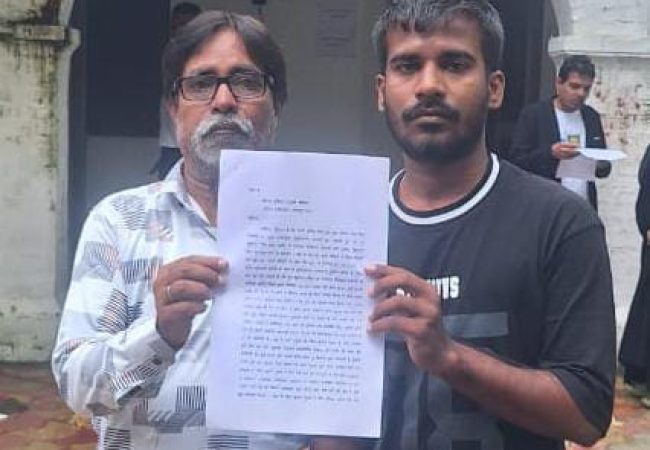

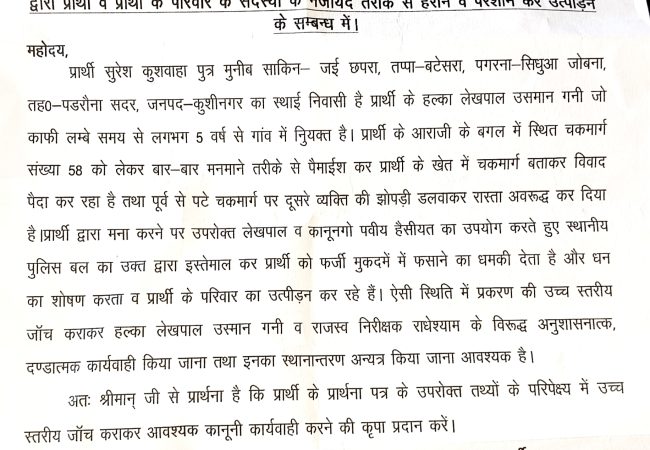

A resident of village Jai Chhapra of Tehsil Padrauna area has accused the Halka Lekhpal and Revenue Inspector of harassment...

Farrukhabad The body of a youth was found inside the bus under suspicious circumstances The youth was coming from Gurgaon to...

Farrukhabad: - The electricity department is not refraining from doing as it pleases on Railway Road. They are placing...

In the case of daylight robbery in Etawah in 2015, the special court has convicted three accused and sentenced them to five...

Badaun - 58-year-old Bhagwan Shree from Hotipur village of Sahaswan Kotwali area died a painful death. While the woman was...

Breaking Badaun A youth who was released from jail a few days ago was attacked with a sharp weapon and was seriously injured...

An awareness rally was taken out as part of the Ground Water Week organized in Mainpuri district. The rally was inaugurated...

Fertilizer crisis in Sarpathi Khurd committee, system locked for two weeks, farmers blew the bugle of agitation Padrauna,...

Badaun Breaking The body of a farmer returning from the field was found lying in water People nearby saw it in the morning...

Badaun In Jarifnagar village, Mohit Gupta, a youth hurt by the beating of his in-laws, poured kerosene on him and set...

Assembly elections are to be held in Bihar this year. Before the elections, the Nitish government has given a big relief to...

The electric pole installed at the intersection in Mohalla Chaudhari of Bhogaon in Mainpuri district has been damaged due to...

A massive fire broke out in a hypermarket in the Iraqi city of Al-Qut on Thursday, killing at least 50 people. According to...

Kanpur, Sales Tax Bar Association Lakhanpur organized a Direct Tax Study Circle meeting. The meeting was started by Akhilesh...

The results of Swachh Sarvekshan 2024-25 have been declared. In which two major cities of Gujarat have been selected. Which...

The results of Swachh Sarvekshan 2024-25 have been declared. In which two major cities of Gujarat have been selected. Which...

Bangladesh is burning in the fire of domestic violence. A violent clash took place between the Awami League and the police...

UIDAI has given important information about children whose Aadhaar cards were made before the age of five. According to the...

UIDAI has given important information about children whose Aadhaar cards were made before the age of five. According to the...

Three important decisions have been taken in the cabinet meeting of the Modi government. One of them is in the interest of...

A seminar of Kanpur Health Committee, constituted of experienced doctors of Kanpur city, was organized at Sumitra Eye Care...

Kanpur, The campaign against school vehicles run by the enforcement department of the divisional transport department has...

In Etawah, storytellers Mani Yadav and Sant Prasad did not get relief from the court in the case of hurting religious...

In Etawah, storytellers Mani Yadav and Sant Prasad did not get relief from the court in the case of hurting religious...

Four people including two women were injured in a head-on collision between an auto and a bike near Birokhi turn on...

24-year-old Monu Jatav, son of Badal Singh Jatav, died of electric shock in Kari village of Chaubia police station area of...

West Indies all-rounder Andre Russell is set to announce his retirement from international cricket. Russell has been...

Farrukhabad: After Dilip's death on 14th July, a new twist has come. Neeraj, wife of Dilip who hanged himself alleging...

Kannada actress Ranya Rao has been sentenced to one year in jail in a gold smuggling case. The order was issued by the...

A passport is required to travel from one country to another, but it will be surprising to know that not only humans but...

There was chaos at Etawah Junction when a passenger fell under the express train going from Patna to Kota. The incident...

Kanpur, Sheela Mishra, wife of late Ajay Mishra, resident of Maksudabad Tehsil Sadar, submitted application forms to...

Kanpur: On the safe return of Shubhanshu Shukla from space, special prayers were offered at the shrine of Khanqah-e-Hussaini...

In the sequence of organized special campaign of CRP and RPF to prevent the continuous incidents of theft at Kanpur Central...

Kanpur Central RPF has rescued a kidnapped minor girl from train number 12424 Dibrugarh Rajdhani. The girl is 14 years old...

Groundwater week was inaugurated in Kanpur, the objective of which is to increase public awareness towards water...

Continuous efforts are being made under the leadership of Cooperative Estate Chairman Vijay Kapoor to resolve the...

Farrukhabad: (Mohammadabad) Due to discord at home, the woman had a quarrel with her husband. Due to which she committed...

Kanhaiya (25), a resident of Patel Nagar in Bakewar town of Etawah, committed suicide by hanging himself from a fan in his...

" Sometimes life brings you to such a point where neither your loved ones are with you nor the circumstances. But at such a...

The journey of devotees immersed in devotion in the month of Sawan turned into a painful accident. A tempo full of devotees...

"The laborer cried for his wife… when relations backed off, two strangers became the support of his breath" Padrauna...

A case of love affair has come to light from Sohrauna village of Padrauna Kotwali area of Kushinagar district, in which a...

A case of love affair has come to light from Sohrauna village of Padrauna Kotwali area of Kushinagar district, in which a...

Padrauna Kushinagar. On Wednesday afternoon, in Tola Manshachhapar of Katai Bharparwa of Jatha Bazaar police station area,...

Padrauna Kushinagar. On Wednesday evening, the Anti Corruption Gorakhpur team took an important action and arrested a...

In Majra Rajpur of Ilahabans Gram Panchayat of Kishani Vidhansabha area in Mainpuri district, the villagers have constructed...

Sunil Gurjar, posted as driver at Kusmara outpost in Kishani area of Mainpuri district, died suddenly while on duty. After...

A tragic road accident took place on Wednesday morning on Vijaynagar-Pachavali Road under Friends Colony police station area...

District Mainpuri has received 11 new four-wheeler PRV vehicles from UP 112 Lucknow headquarters. The vehicles received...

Friends Colony police have arrested three clever thieves while they were planning a theft. These thieves used to do recce of...

In Kishani area of Mainpuri district, SDM Gopal Sharma along with his team launched a campaign against polythene in the...

Dr RC Gupta, Chief Medical Officer of Mainpuri district, inspected Mohalla Shaheed, Fazilganj and Green Valley School of...

An accident happened on NH 91 highway in Mainpuri district. In which a truck hit a highway authority car parked on the...

Bridge Collapse Risk in Gujarat: The government has woken up after the Gambhira Bridge accident. All the bridges in the...

An auto rickshaw lost control and overturned at Surajpur turn in Airwa Katra police station area of Auraiya. The driver lost...

Badaun police is once again in the headlines for its actions. Woman consumed poison outside SSP office, condition serious....

Transport businessman, wife and daughter went to Kedarnath From our representative A transport businessman from the small...

Loan Scams: The heinous business of apps and agencies that trick gullible people and charge huge amounts from them in the...

This year, gold prices have risen by 30 percent and silver prices by 25 percent. Mumbai, Date 15: Silver has also caught up...

A major accident has taken place on the Rudraprayag-Badrinath highway in Uttarakhand. Here, a bus packed with passengers...

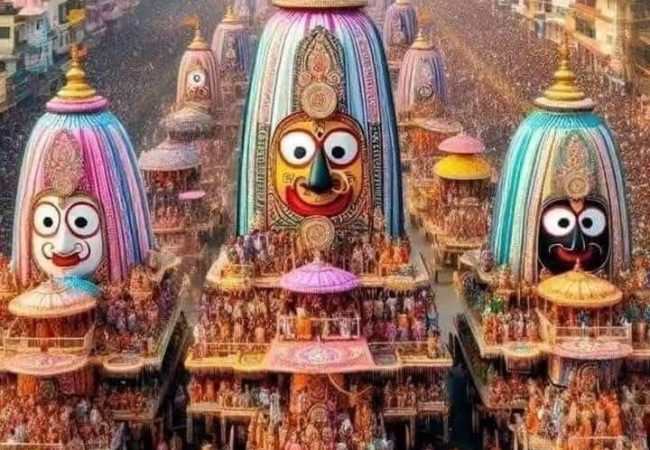

Today, Ashathi Bij, i.e. on June 27, 2025, Lord Jagannathji's Rath Yatra will start across the country including Gujarat. At...

Heavy to very heavy rains are falling in Gujarat. In the last 24 hours, 155 talukas in the state have received rain,...

A suicide bomber targeted a military convoy in the Khaddi area of North Waziristan in Pakistan's Khyber Pakhtunkhwa province...

The ongoing discussions to change the Chief Minister in Karnataka for the last few days came to a complete halt on Wednesday...

Ten central trade unions of the country have jointly called for a Bharat Bandh on July 9, 2025. More than 25 crore employees...

Road Accident In Mahisagar: Road accidents in Gujarat are continuously increasing. Then a triple accident has come to light...

According to the information given by the Meteorological Department on Sunday, monsoon may set in some parts of Gujarat...

A village accident has occurred in Jammu and Kashmir's Doda district. Five people have died and more than 10 people have...

A family living in a house near the Nayug School near Sadar Bazaar in Fateganj area of Vadodara city had gone to sleep at...

According to the information received by the District LCB, a truck was found parked in the parking lot of Shraddha Hotel...

Jamnagar's government GG Hospital parking lot suddenly became a traffic jam at 12 noon on Tuesday. Due to the traffic jam...

After the interesting results of the recent Gram Panchayat elections in Vadodara district, the election of Deputy Sarpanch...

After the interesting results of the recent Gram Panchayat elections in Vadodara district, the election of Deputy Sarpanch...

In the case of the attack on the former member of Jamnagar District Panchayat and the Sarpanch of Vadwala village in...

In the case of the attack on the former member of Jamnagar District Panchayat and the Sarpanch of Vadwala village in...

It seems that now it has become a common practice in Gujarat that a major accident happens, people die and then the...

There are 33 collectors in Gujarat, but Collector IAS Arpit Sagar has come into the limelight for his strict action. Arpit...