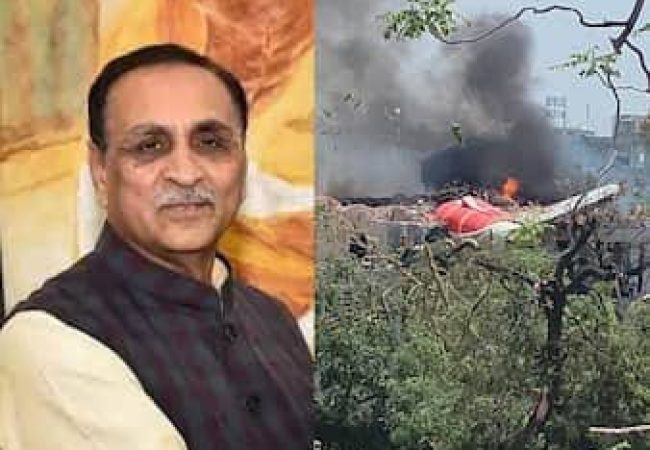

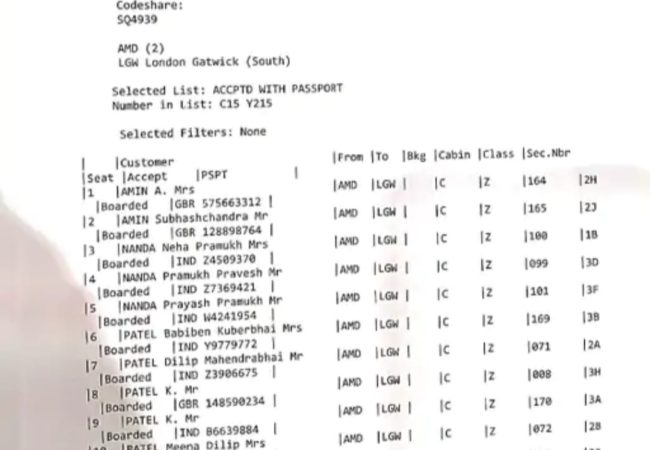

The plane crash in Ahmedabad is currently India’s biggest accident, in which a large number of casualties and property damage have been reported. In such a situation, the amount of insurance claim can be very high. It is estimated that this amount can reach Rs 1500 crore. India has signed the 1999 Montreal Convention in 2009, due to which special rules will be applicable on insurance claims for air accidents and losses. It is noteworthy that the AI 171 plane crashed on Thursday (June 12) on the hostel of the Medical College and 241 passengers on board the plane died. However, one passenger survived the accident. It has been reported that a total of 265 people died in the accident. Given the type of damage caused in the Ahmedabad plane crash, such an amount on the insurance claim is not surprising. According to information received from government sources, some key things related to insurance have been told. According to which the aviation policy is led by Tata AIG General Insurance. It is supported by co-insurance companies like GIC RE, United India, Oriental Insurance and ICICI. About 95% of the risks are reinsured by large global companies. These include AIG, AXA XL and other reinsurers in London and Bermuda. The Boeing 787-8 aircraft was completely destroyed in this horrific accident. Its insurance, depending on its age, is around Rs 650-700 crore. Under the Montreal Convention, the families of the deceased passengers are entitled to about Rs 1 crore per family, which has already been announced. With over 240 deaths, this payout could exceed Rs 240 crore. Depending on the final settlement and legal claims, the amount of this risk coverage could cross Rs 1000 to 1500 crore.

Insurance claim amount for plane crash in Ahmedabad likely to reach Rs 1500 crore