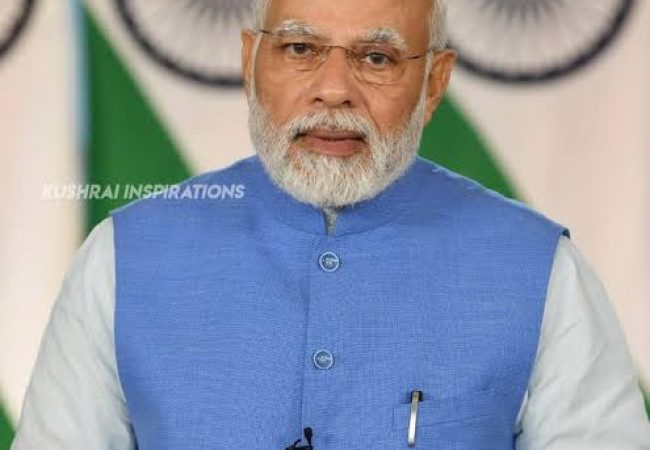

*Chief Minister Shri Bhupendra Patel’s important revenue decision in the broad interest of the small and middle class people of the state* *Up to 80 percent of the duty payable for transfers made by societies, associations and non-trading corporations through allotment letters – share certificates will be waived* *The Chief Minister’s sensitive and positive approach towards the representations of the people – public representatives* Chief Minister Shri Bhupendra Patel has decided to give a big discount in the amount of duty payable for housing transfers to small and middle class families in the state. According to this important revenue decision taken by the Chief Minister, up to 80 percent of the duty payable for transfers made by societies, associations and non-trading corporations through allotment letters, share certificates will be waived and only 20 percent of the duty will be collected. Such amount payable under Section 9 (a) of the Gujarat Stamp Act, 1958 will be relaxed. Due to the provisions made by the Revenue Department of the State Government in the Stamp Act, the financial burden on the middle class people in such cases of transfer was being borne by them. Chief Minister Shri Bhupendra Patel has taken a positive approach in this regard, showing sympathy towards the representations of such small middle class people. According to the decision he made in this regard, now only the amount of duty payable, which is 20 percent of the original duty and the amount of penalty, will be collected. Thus, by reducing the amount of stamp duty payable by the State Government, the amount of penalty in addition to the duty will be calculated, and the same amount of duty will be payable in relation to the property before the revised provision. With this positive and citizen-centric approach of Chief Minister Shri Bhupendra Patel, there will be no additional financial burden of penalty on the people in such cases of transfer. It is important to point out here that the provisions of the notification to be issued pursuant to this decision will be applicable only to transfers made by societies, associations and non-trading corporations through allotment letters and share certificates.

Chief Minister Bhupendra Patel’s decision