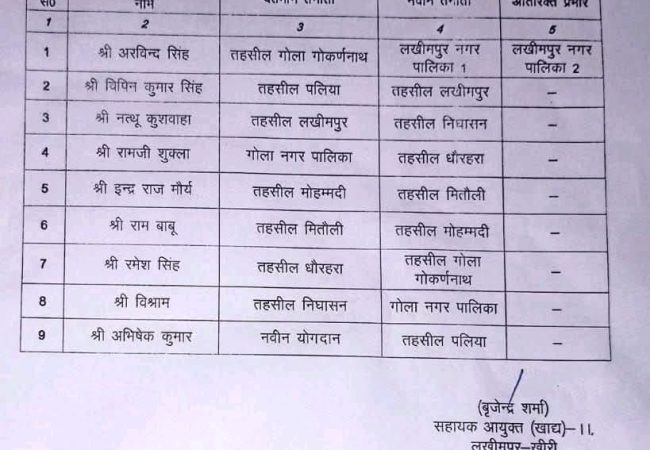

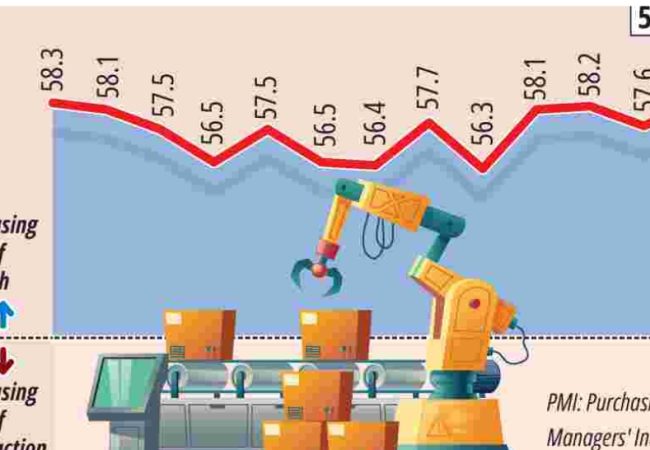

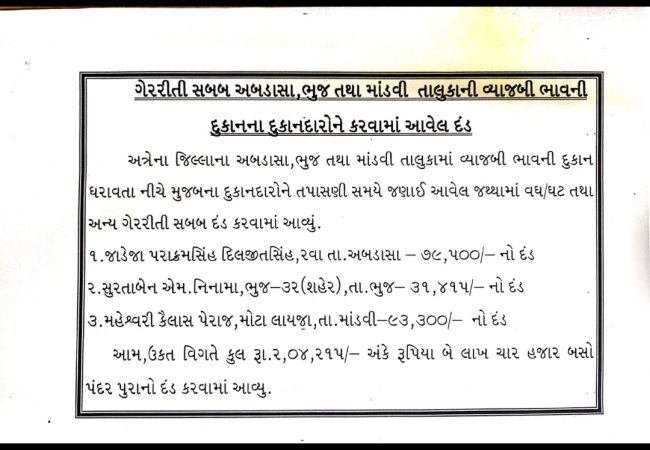

Gujarat University Animation Scam Revealed Direct Tax Collection Rises India’s direct tax collection for the financial year 2025-26 has increased by 4.86 per cent to Rs. 5.45 lakh crore as on June 19, according to the latest data released by the government. However, there was a marginal decline in net tax collection due to a sharp rise in refunds. If we talk about total tax collection – which includes corporate tax, non-corporate tax, security transaction tax (STT) and other charges – it has increased from Rs. 5,19,936 crore to Rs. 5,45,207 crore during the same period last year. Also read: Good news for taxpayers, new facility for ITR filing launched Big increase in tax refunds Tax refunds have increased by 58.04 percent, from Rs 54,661 crore a year ago to Rs 86,385 crore. This increase in refunds is probably due to better taxpayer services and faster processing. As a result, there has been a slight decline of 1.39 percent in net direct tax collection, which has decreased from Rs 4,65,275 crore last year to Rs 4,58,822 crore. On the other hand, according to government data, there has been a 3.87 percent increase in advance tax collection, which has reached Rs 1,55,533 crore. Corporate advance tax has increased by about 6 percent and this figure has reached Rs 1,21,604 crore, but non-corporate advance tax has decreased by 2.68 percent to Rs 33,928 crore.

Government treasury filled with income tax, Rs 5.45 lakh crore in 80 days